Employee Investment

Competition

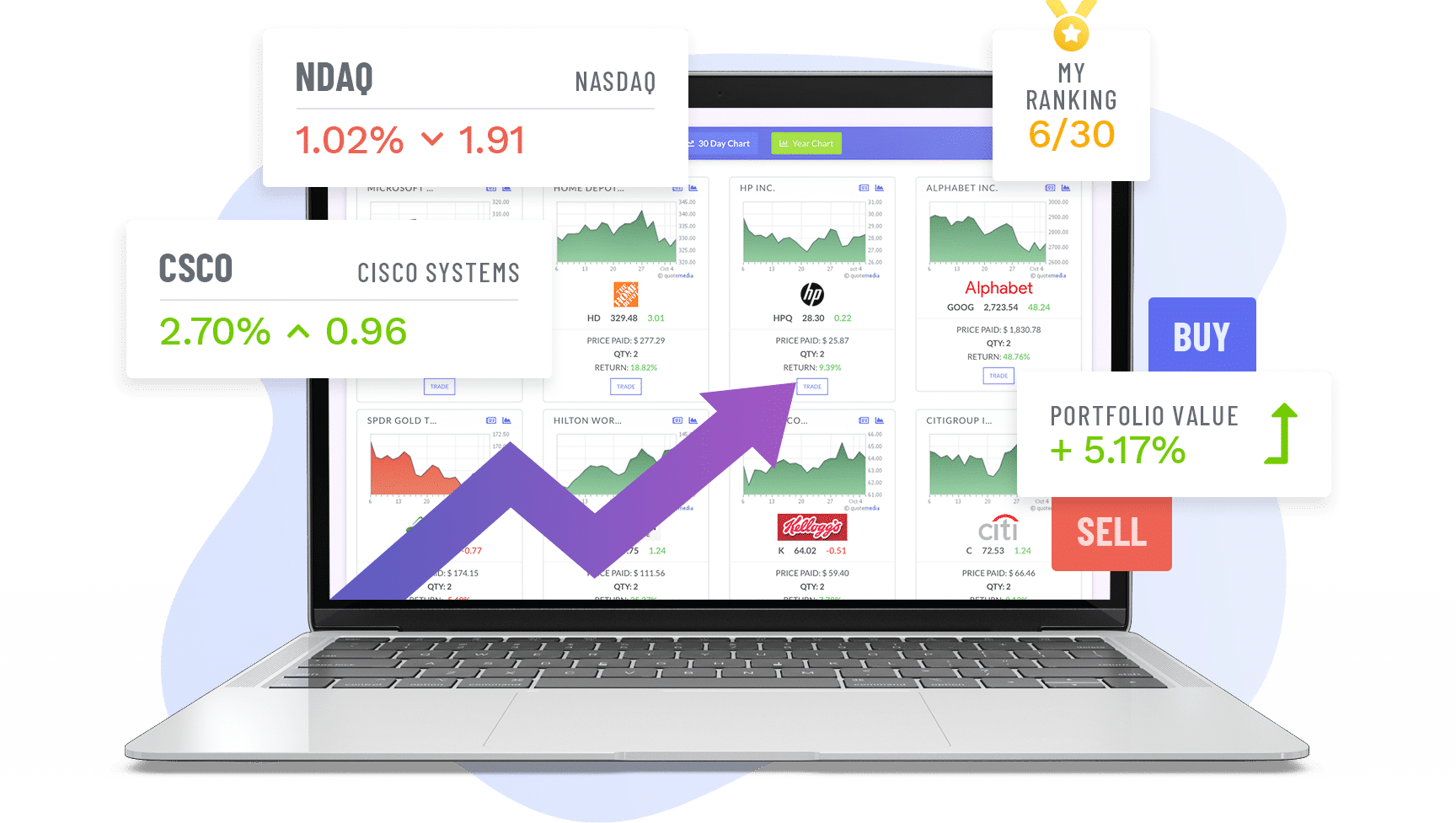

Boost Company Morale by Getting your Team

Involved in a Virtual Trading Challenge!

A friendly competition is a great way to expose your employees to different investing strategies and securities they could be offering your customers. Banks, credit unions and brokerage firms have used our platform to get interns or front-end workers familiar with the financial markets.

Schedule a commitment-free consultation to discover the different packages we have available to fit any size program you want to launch.

Schedule a Consultation