Precious metals, particularly gold and silver, are attractive investments to many people. But as usual, you must learn to become a knowledgeable investor as precious metals can fluctuate in value as rapidly as common stocksStocks are “equity investments”, which means that individuals who own stock shares of a company actually own part of that company. From a real world prospective, investing in gold or other precious metals has some advantages that other investments do not.

Precious metals, particularly gold and silver, are attractive investments to many people. But as usual, you must learn to become a knowledgeable investor as precious metals can fluctuate in value as rapidly as common stocksStocks are “equity investments”, which means that individuals who own stock shares of a company actually own part of that company. From a real world prospective, investing in gold or other precious metals has some advantages that other investments do not.

For example, you should have up to five options on how you’d like to invest in precious metals.

- Coins and bars: If you enjoy a high degree of “tangibility,” accumulating coins or gold bars should satisfy that craving.

- Certificates: If you’d rather not have your spare bedroom filled with gold bars, choose certificates that indicate your ownership in specified amounts of precious metals.

- Precious metal mutual funds: If you’d like to spread your risk over several precious metals, you might like this option.

- Purchase stock directly in mining corporations: Get right to the source of your favorite precious metals if you wish (for example, Barrick Gold (ABX)).

- Purchase precious metal futures: This is often the most “exciting” (and risky) option as you would gamble a bit on what gold or other precious metals will be valued in the future.

Investing in precious metals is more challenging then trading stocks. With Apple Computer (AAPL, we all know what a Apple computer, an iPhone and an iPod is so at least we think we understand the company. But investing prudently in precious metals is much more complicated since it is a global commodity, an inflation hedge, an interest rate hedge, and a the-world-is-ending-soon hedge.

That being said, many advisors are recommending everyone own up to 10% of one’s portfolio in precious metals.

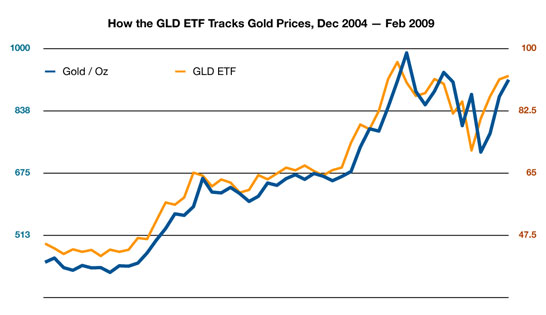

You can trade precious metals using the following ETFsExchange Traded Funds are a cross between mutual funds and stocks. ETFs are simply a portfolio of stocks or bonds or other investments that trade on a stock exchange just like a regular stock does. : GLD (to buy Gold) and SLV (to buy Silver). Look how the GLD ETF effectively matches the spot price of gold:

These ETFs allow regular stock traders to trade these precious metals in a stock account without going into the riskier futures markets.

At Virtual-Stock-Exchange, you can also trade these ETFs, but you also have access to trading commodity spot contracts directly (buying and selling gold, oil, corn, and more).

At StockTrak, you can trade both the ETFs and Spots, but you also can trade commodity futures and even future options!

Teacher Introduction Webinars

Teacher Introduction Webinars Feature Highlight – Assignment Rewards!

Feature Highlight – Assignment Rewards! 2-01 What Are Stock Exchanges?

2-01 What Are Stock Exchanges? Basic Option Strategies

Basic Option Strategies