A company’s net income is one of the most critical pieces of data you can pull out of the financial statements because it is this profit that generates cash and cash drives value. A company can produce the most innovative products, be in an industry with minimal competition, and have superior management, but the company may still not be viable if they do not translate these positives into good earnings and strong cash flow.

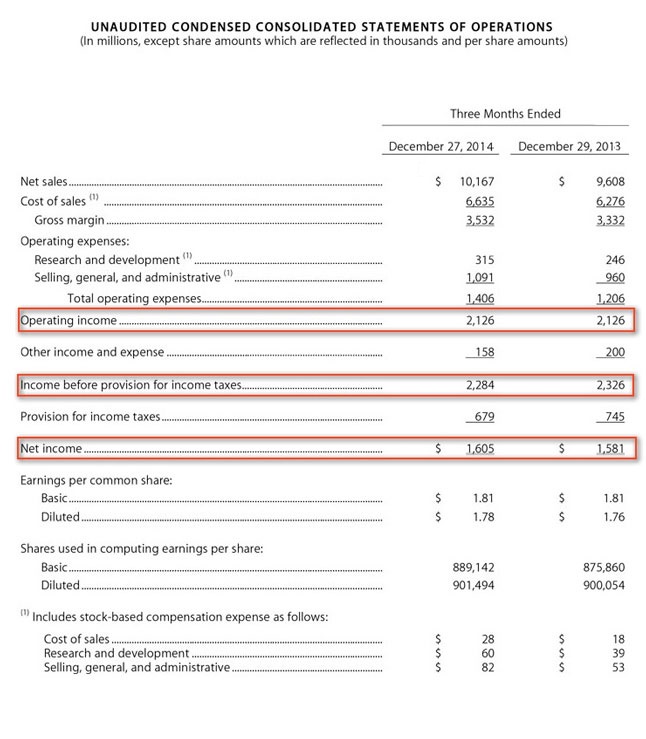

The Income Statement from the 10-Ks The annual SEC filing by public companies that includes their audited Income Statement, Balance Sheet, Cash Flow Statement and other detailed notes about the companies financial and operating conditions. and 10-QS The quarterly SEC filing by public companies that include abbreviated, unaudited financial statements. is the first place to start. Take a look at Apple’s Income statement from a recent 10-Q and you will see their Operating Income, Income before taxes, and then Net Income:

Make sure you look at the Net Income line with caution as it might not necessarily be showing you the number you are expecting to see. It is important that the Net Income line be showing a profit, but sometimes there are extraordinary or non-recurring items that impact the Net Income that will muddy the picture. A company may lay off 10% of its work force and have a one-time expense of its severance package, or it may sell-off a business for a one-time profit that shows up on its Income Statement. These non-recurring items can make the Net Income line meaningless and misleading.

Make sure you look at the Net Income line with caution as it might not necessarily be showing you the number you are expecting to see. It is important that the Net Income line be showing a profit, but sometimes there are extraordinary or non-recurring items that impact the Net Income that will muddy the picture. A company may lay off 10% of its work force and have a one-time expense of its severance package, or it may sell-off a business for a one-time profit that shows up on its Income Statement. These non-recurring items can make the Net Income line meaningless and misleading.

It is more important that the company is actually making a profit from its normal business operations and not from picking up one of these one-time events. The Income Statement should contain data showing that a company is actually “earning” a profit. Learn to separate operating results from overall results.

For example, suppose Company A showed a substantial Net Income during the most recent annual period that was well ahead of last year’s performance. However, upon close inspection, you discover that much of this profit was generated from a sale of assets, accounting entries, or other extraordinary (as in “extra ordinary”) events. When you eliminate all of the non-recurring line items on the Income Statement, you might discover that Company A only earned very modest net income from operations. This should raise a red “caution flag” to challenge you to investigate further and read the reports closer.

Conversely, suppose Company B showed a net loss on its Income Statement in its most recent accounting period. However, upon further investigation, you learn that the reason for this loss was because the company took a “one time charge against earnings” because it closed a non-profitable business, terminated 1,000 employees, and paid them all a severance package. When you review the company’s income from operations, you see the excellent earnings data that the company exhibited in prior years. Company B may be the better longer-term investment even though it is showing a net loss for the current year.

EBITDA

An easy way to see the performance of a company is through a metric called EBITDA Earnings before interest, taxes, depreciation, and amortization. . It is a complicated looking, but very useful bunch of letters. It stands for “Earnings Before Interest, Taxes, Depreciation and Amortization.” This line item on the Income Statement throws out all the extraneous activity in a company and reduces the core business operations into the number that is most used to evaluate the operating performance of a company.

Teacher Introduction Webinars

Teacher Introduction Webinars Basics Of Payroll Accounting Presentation

Basics Of Payroll Accounting Presentation How do candlesticks imply volume? Why is that critically important?

How do candlesticks imply volume? Why is that critically important? Preparing for Spending Shocks

Preparing for Spending Shocks