Just like we all care about our personal health, managers and investors care about the health of their company. How can they perform a “check-up” on their business in order to determine its progress and financial health? Instead of weight or blood pressure, analysts use financial ratios.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.

“Asset Allocation” is how you have divided up your investments across different assets. You can have all your assets in one place, or you can use diversification to spread them around to reduce risk.

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. The MACD moves two trend following indicators and moving averages into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The result is that the MACD gives the best of both worlds: trend following and momentum.

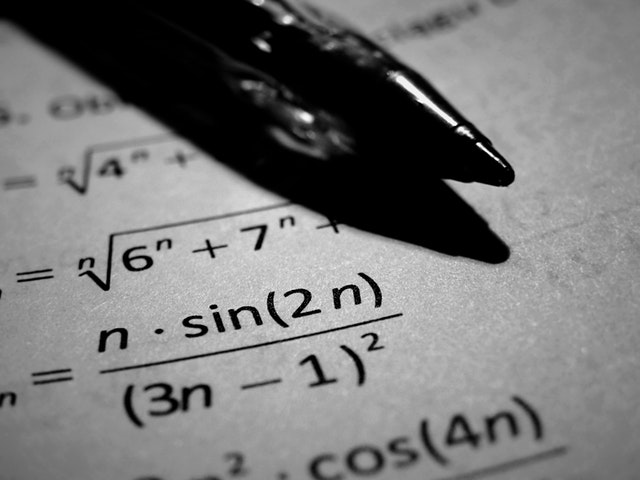

The Black-Scholes formula is the most popular ways to calculate the “true” price of an option.

Free Cash flow is the cash available to all the capital providers of a company. There are two types of free cash flows: 1) Cash flow available to pay out to all capital providers and 2) Free Cash Flow to Equity (FCFE).

The Form-8K is a SEC-mandated report filed by public companies to report unexpected events or transactions that are material in nature, and thus have an impact on the share prices of the company.

Fixed income analysis is the process of evaluating and analyzing fixed income securities for investment purposes. Read this article to discover the elements of fixed income analysis.

Discounted Cash Flow (DCF) is a valuation technique or model that discounts the future cash flows of a business, entity, or asset for the purposes of determining its value.

Covariance is a statistical measure of the extent that 2 variables move together relative to their respective mean (or average) values.

Account Receivables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing sales offered on credit. If efficient, receivables management can lead to good sales growth, healthy cash flows, profitability, and stable operating cycles.

Account Payables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing its trade credit purchases. It is an important working capital amount that can enhance a company’s short-term cash flow position.

Modern Portfolio Theory (MPT) is an investment theory whose purpose is to maximize a portfolio’s expected return by altering and selecting the proportions of the various assets in the portfolio. This article discusses the assumptions of MPT, and its limitations.

Duration measures the percentage change in the price of a bond (or value of a bond portfolio) due to a change in market interest rates (also known as the yield).

Return on Equity (ROE) is one of the most important pieces of data that investors and creditors use to evaluate a company’s potential to grow and profitability. Dupont Analysis breaks the ROE into several different components in order to analyze where the returns are coming from.

Depreciation refers to the gradual and permanent decrease in value of the assets (referred to as a depreciatable asset) of a firm, nation or individual over its lifetime.

In the world of stock analysis, fundamental and technical analysis are on completely opposite sides of the spectrum. Fundamental analysis focuses on financial statements, while technical analysis looks at stock charts

The Cash Flow Statement is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). This statement presents where the cash and its equivalents are coming from and where they are being allocated.

Fundamental analysis is the process of looking at the basic or fundamental financial level of a business, especially sales, earnings, growth potential, assets, debt, management, products, and competition.

The Sharpe Ratio looks at a portfolio’s return over time, then gives it a rating based on how volatile the returns are. Portfolios with steady returns have a better Sharpe Ratio than portfolios with high returns but big swings

Capital Asset Pricing Model (CAPM) is a method used by investors to prioritize what stocks to invest in, given their limited cash.

Form 10-Q, is also known as a 10-Q or 10Q, is a quarterly report mandated by the United States federal Securities and Exchange Commission, to be filed by publicly traded corporations.

A Dividend Yield is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. In the absence of any capital gains, the dividend yield is the return on investment for a stock. The formula is Annual Dividends Per Share divided by Price Per Share.

EPS (Earnings-Per-Share) measures how much of a company’s net income actually trickles down to each outstanding share. EPS is a good estimator of how much money each shareholder is entitled to from the profits of the company.

Fundamental Analysis is the process of looking at the basic financial level of a business by assessing factors like sales and earnings.