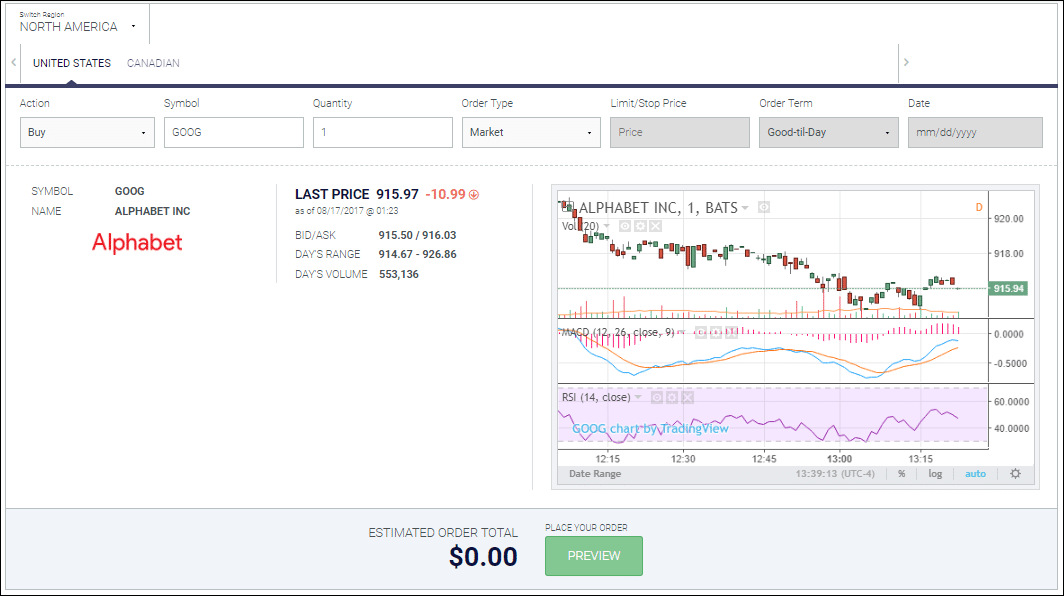

A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Read this post to learn about the components of a long stock, and what it looks like graphically.

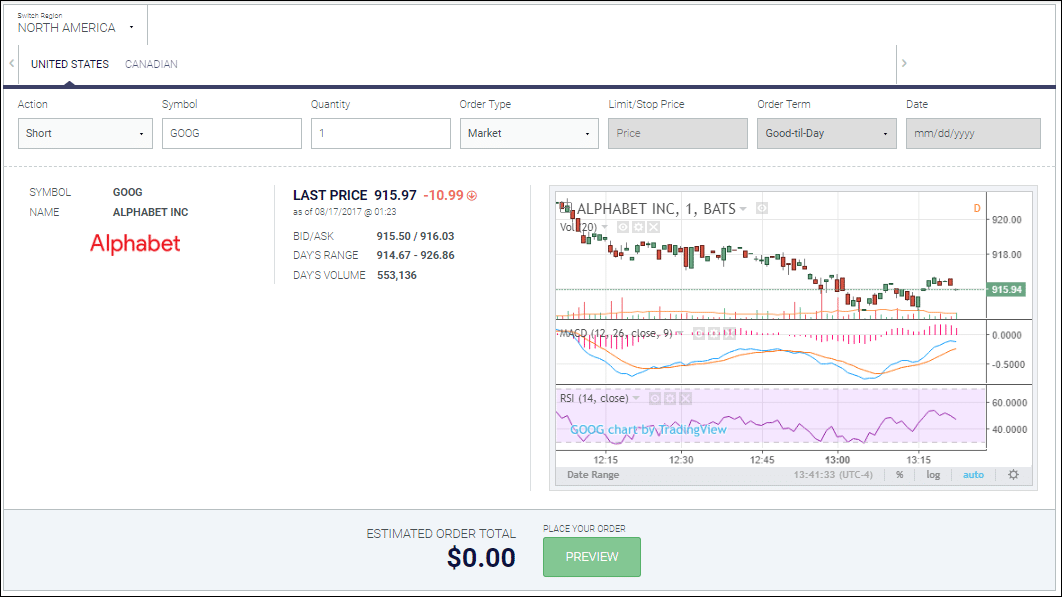

A short stock is an expression used when you sold shares of a company that you did not own beforehand, and is described in more detail in this post!

Stocks are a share of ownership of a company. If you own a stock, you are involved in some of its management decisions, and you are entitled to some of the company’s profits.

“ETF” stands for “Exchange Traded Fund”, which is exactly how it sounds; they are like mutual funds in many ways, but they trade on a normal stock exchange like a stock, with their value being determined both by the value of the underlying assets and the value of the ETF itself.

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indecies (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions. However, using financial derivatives and debt, there are also “Leveraged ETFs”, which amplify the risks, and returns, of whichever index it is following. Read this article for a list of Leveraged ETFs.

Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders and Trailing Stop Orders! Each one is used differently to balance a trading strategy – usually so you can place your orders and wait for prices to match your conditions