Most people trading on their own will use a basic cash account – you deposit your cash into your brokerage account, which you then use to buy securities like stocks and bonds. For professional investors, like day traders and financial professionals, there are ways to multiply the investment amounts and returns by using more complex types of brokerage accounts and trading strategies. This includes margin accounts, which lets investors borrow money to invest, international investing, or buying stocks and bonds from other countries, and using market timing strategies to try to “beat the market”.

Margin Accounts

When investing, an investor deposits money within an account with their broker. There is a choice of two types of accounts in which to deposit the money: a cash account or a margin account.

When investing, an investor deposits money within an account with their broker. There is a choice of two types of accounts in which to deposit the money: a cash account or a margin account.

If the investor has a cash account, they can only invest with the amount they deposited in the account. The investor must pay the full sum of each investment, including any transaction fees associated with the investments. With this type of account, borrowing from their broker is not an option.

In comparison, a margin account has the option of leveraging. Leveraging is where the investor can borrow money from their broker to use for investing. The purpose of this is to that it provides the investor with greater buying power. An increase in the money invested results in an increase in returns(profits). After closing positions on stocks or financial instruments, the money borrowed must be repaid to the broker along with interest.

Example

If an investor had $50 and wanted to invest in a stock or financial instrument, they could borrow another $50 from their broker and then invest $100 into the stock. If the stock value increases, the investors profits are higher (double in this example). The risk in this scenario is that when borrowing from your broker, the investor can lose more money than they have. If the stock lost all its value, the investor loses $100 instead of $50. Then the investor would owe the broker $50 plus interest, which is money that the investor did not initially have.

Anatomy of a Margin Account

The margin accounts will have a balance made up of the investors own money and money the investor borrowed from the broker. The amount that the investor can borrow from the broker is determined by the maintenance margin.

The maintenance margin is an amount that the investor’s own money cannot go below. It is given as a percentage of the whole account balance. If the maintenance percentage is set at 30% for example, this means that the investors own cash must always account for at least 30% of the balance in the account. If the account is losing money and is down from $100,000 to $70,000, 30% of the funds left must be the investor’s cash.

When the account goes below the maintenance margin, the broker makes a margin call. A margin call is when the broker calls the investor and informs the investor that they must increase the cash amount in the account to meet the maintenance margin. The investor should deposit more money – if they do not, the broker has the right to sell any of the investor’s other investments to meet the maintenance margin of the account.

Short Selling

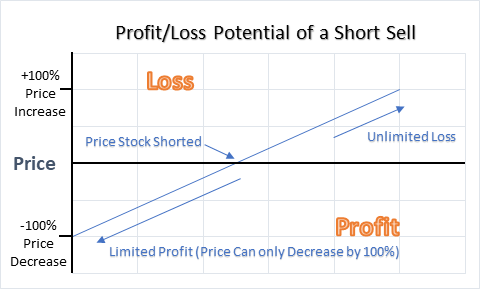

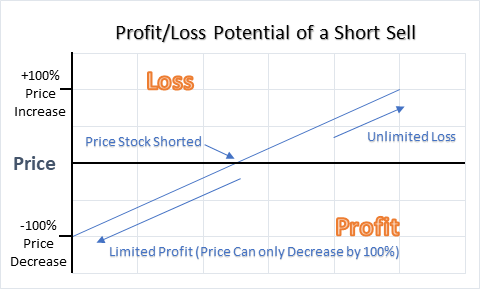

When an investor buys a stock or other financial instrument, they expect that the price will increase. Short selling is the opposite. The investor sells the stock or financial instrument aiming to profit when the price goes down.

The investor does not own the stocks to short. Instead, the investor borrows shares from a lender and sells them, then the investor buys the stock back and returns the shares to the lender. To make profit, the investor sells the stock at a high price and buys the stock at a lower price. The profit is the difference between the price the investor sold and bought the stock multiplied by the number of shares shorted. The potential profit when short selling is 100% if the stock price, (i.e. if the stock itself) loses all value. Therefore, potential profit is limited.

There is a huge risk with short selling. If the price of the stock or financial instrument increases, the investor is at a loss. The stock price can reach any height and therefore the potential loss is unlimited. Investors short stocks or financial instruments due to speculation or if they want to hedge positions on investments.

Example

If the investor short sells 50 shares of a stock that is trading at $10 and the price depreciates to $8, the profit is $100 (50 shares x $2 price change). In the opposite scenario if the price increases by $4 going from $10 to $14 the loss is $200 (50 shares x $4 price change).

To be able to short sell, the investor needs a margin account. With unlimited potential losses in short selling, the balance could fall below the maintenance margin if the stock experiences a huge spike in price.

Market Timing

Market timing is an investment strategy where the investor buys or shorts stocks and financial instruments based on their expectations of what might happen in the market. This is the “Buy low, sell high” idea – trying to buy stocks just before the prices go up, and selling them at the peak.

Market timing is an investment strategy where the investor buys or shorts stocks and financial instruments based on their expectations of what might happen in the market. This is the “Buy low, sell high” idea – trying to buy stocks just before the prices go up, and selling them at the peak.

The success of the strategy depends on how well an investor can predict the market. The investors predictions can be based on economic indicators or technical factors such as trends. The investor would need to be very familiar and educated with using economic data and technical analysis to have a market timing strategy. The investor uses these factors to decide which companies or industries to invest in or to short sell. Trading styles can be either active or passive. Active investing is frequent investing. In comparison, passive investing is a buy and hold type strategy. Market timing would fall under an active trading style.

Example

When President Trump was elected, using a market timing strategy to invest in banking stocks before the results of the election would have been very profitable. An analysis of President Trump’s policies would have suggested benefits for the investment banking industry. When President Trump won the election, there was a spike in their stock prices of investment banks. However, by investing in investment banks, investors were betting that Trump would win. Most investors had bet on Hilary Clinton winning. Therefore, their market timing strategy was unsuccessful.

Many academic studies have found that market timing is not a successful trading strategy, in favour of long term investments. However, this is debated by active traders who argue in favour of market timing. In general, it is considered an unreliable method of investing as the market is unpredictable. Majority of investors who have a market timing strategy are unsuccessful. Comparing strategies, long term investing strategies have many more success stories.

International Strategies

A portfolio has an international investment strategy if it has investments in foreign markets. An international investment strategy offers the investor the opportunity to lower the risk of their portfolio and to take advantage of possible investment opportunities in foreign markets. It reduces risk through diversifying. Diversifying is where the investor invests in more than one market to reduce the risk to any specific market. Instead of being fully invested in domestic markets, the domestic market holds a smaller percentage of investments with investments in foreign markets making up the rest of the portfolio. If the investor was to only focus on American markets and if the markets took a dive, it would be very difficult to protect the portfolio from taking a hit. Therefore, if they had investments in many markets internationally, the investments in other markets would be safe. The investor’s portfolio of investments would not be as exposed.

A portfolio has an international investment strategy if it has investments in foreign markets. An international investment strategy offers the investor the opportunity to lower the risk of their portfolio and to take advantage of possible investment opportunities in foreign markets. It reduces risk through diversifying. Diversifying is where the investor invests in more than one market to reduce the risk to any specific market. Instead of being fully invested in domestic markets, the domestic market holds a smaller percentage of investments with investments in foreign markets making up the rest of the portfolio. If the investor was to only focus on American markets and if the markets took a dive, it would be very difficult to protect the portfolio from taking a hit. Therefore, if they had investments in many markets internationally, the investments in other markets would be safe. The investor’s portfolio of investments would not be as exposed.

For active traders who have a market timing strategy, major international events would provide them with much more opportunities to trade. They would have many more events to speculate about. Similar passive traders would have a much wider range of stocks and financial instruments to choose from, providing greater opportunity to make profit.

The trade-off to this extra diversification is more risk. Each country has unique political situations that could affect investments, which need to be carefully tracked and understood. International investing also exposes investors to currency exchange rates. Exchange rates may also effect the return on investments, and so also are a very serious consideration. The investor must be aware of all factors that could affect an investment as they may not have the same knowledge and exposure to information about foreign markets.

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Get PersonalFinanceLab

[qsm quiz=135]