In its simplest form, short selling is selling shares that you don’t own. Just like the broker will loan you cash to buy more shares, the broker will also loan you shares that you can sell. When you sell shortBorrowing shares from your broker to sell a stock that you don’t own with the hope Read More…

When you are opening a real brokerage, you will be asked if you want to open a Margin Account. Buying on margin means that you purchase securities using some of your own cash and you take a loan from your broker to complete the purchase. The collateral for the loan is the stocks or cash Read More…

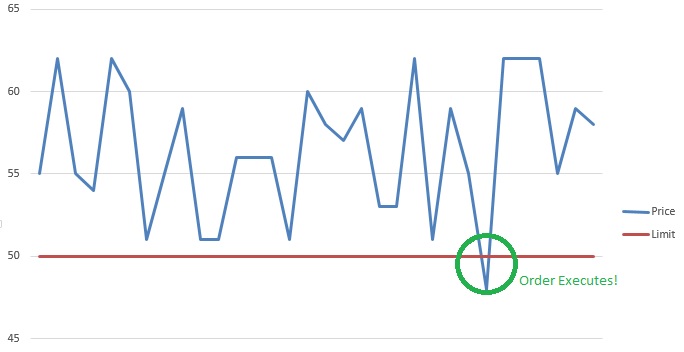

As you might expect, just because you place an order, it does not necessarily get executed. Both the timing and the duration of your orders are important to successfully managing your portfolio. When you place the orders mentioned above, you will usually be allowed to specify the duration of the order. You might be placing Read More…

Once you have the ticker symbol for the company you wish to trade, you are ready to place your first order. Go to your free virtual trading account and you’ll see several options for order type—market, limit and stop. You have already found the symbol to trade “LUV” and you can enter any quantity of shares Read More…

You can easily use the quote page on your brokerage account to locate stocks you might want to buy. If you know the ticker symbol you want to buy, or know the company’s name, you should be successful in locating the current price and status of any publicly traded security. Remember, some companies have multiple Read More…

The first thing you must understand about trading stocks is that the exchanges have assigned each stock a unique “ticker symbol” for identification purposes. When researching stocks, getting quotes, and placing trades, you usually have to know the ticker symbol. Stock ticker symbols are usually 1 to 5 letters long. (Occasionally they contain a “.” Read More…

Glossary Ask Price: The price that sellers want to sell for is called the “Ask” price. Bear Market: A prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices. Bid Price: The price that buyers are willing to pay is called Read More…

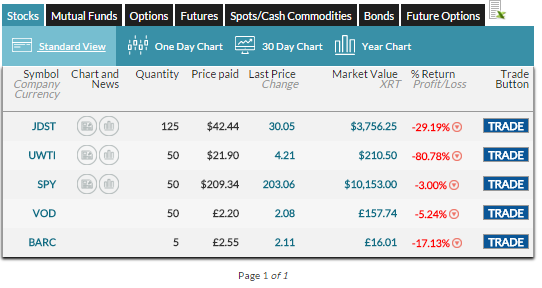

As a newer investor, you should also be aware that you can save some research time by investing in mutual funds instead of individual stocks. Mutual funds contain a mix and diversity of stocks in which you will spread out one investment into many small blocks of shares. Mutual funds and ETFs (exchange traded funds) Read More…

While the wild roller coaster swings of the market make the media highlights, stocks remain an excellent choice to achieve a high – and steady – return. In finance textbooks, this is called return on investment (ROI) and is one of the most important measures of all investments choices. After all, when comparing different investment Read More…

When you are ready to make your first trade you must open a brokerage account. Brokers generally fall into two categories: full service and discount brokers. Full service brokers like to make the decisions for you and will call you frequently with their ideas, suggestions and corporate research—but they will also charge you a hefty Read More…

The mere perception that a market is becoming Bearish is not a predictor of disaster. Fortunes have been made in Bear MarketsA prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices.. The trick is to know when one is coming Read More…

Bull and Bear MarketsA prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices. play a strong role in extending or ending business cyclesThe typical business cycle consists of periods of economic expansion, contraction (recession) and recovery to a new peak.. Read More…

Now that you know what the stock market is and what role the Stock ExchangeStock exchanges are simply organizations that allow people the ability to buy and sell stocks. play, let’s take a step back and look at how stock prices and the economy move. As you might expect, timing is extremely important in investing Read More…

Now that you know what an exchange is, it’s necessary to make a very important distinction between what shares trade on exchanges and what shares don’t. Most companies are private companies and don’t trade on exchanges. The barber shop and the florist on the corner, the guy that cuts your grass, and the plumber that Read More…

In addition to the New York Stock Exchange, there is also the American Stock Exchange (AMEX) and NASDAQ. In the past, the NASDAQ was for smaller companies that were just getting started, and it was prestigious for them to move up to the NYSE or AMEX. These smaller companies included a few you might have Read More…

In the mid 1600s simple fences denoted plots and residences in the New Amsterdam settlement in what we now call lower Manhattan Island. This location on the island was critical as it allowed easy access to both the Hudson River and the East River. To protect this settlement, in 1653, the Dutch West India Company Read More…

So what exactly are “Wall Street” and the “New York Stock ExchangeStock exchanges are simply organizations that allow people the ability to buy and sell stocks.”? You have probably heard these words thousands of times, but unless you are a stock owner they might have gone in one ear and out the other. Stock exchanges Read More…

Bond (Corporate, Treasury, or Municipal): A debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest payments based on the coupon rate, and eventually repays the borrowed amount ($1,000) to the lender at the maturity date of the bond. Certificates Read More…

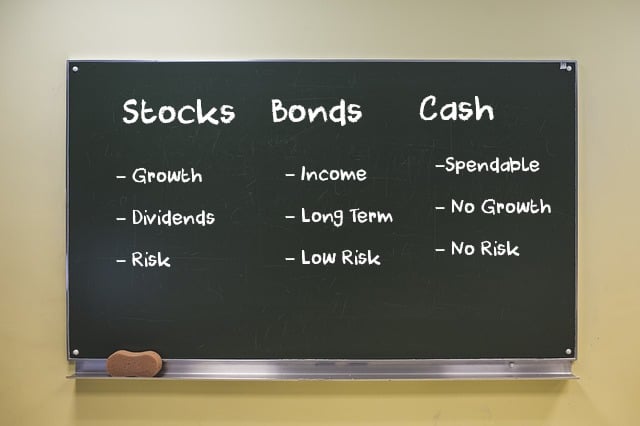

Regardless of your choice of investment types, you should learn about and understand the correlation of risk to the size and type of your investments. First, become familiar with the traditional risk levels of various types of asset groups ( stocksStocks are “equity investments” which means that individuals that own stock shares of a company Read More…

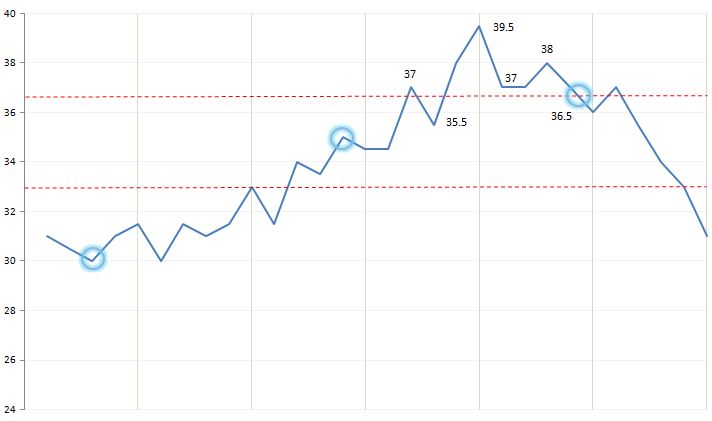

For those just beginning, a good point of reference is the recent performance of the common investments described above. How have they done over the last five years? These charts illustrate their performance over the same time period. When looking at the charts, keep in mind what you read earlier in the lesson and what you’ve Read More…

Buying and selling real estate as an investment strategy is quite different from simply buying a home or commercial building. Just as important in determining FMV (fair market value) as comparable properties are when buying a home, the income stream generated by a property is a primary component for an investor. You typically have three Read More…

Investing in FX (foreign exchange), currency speculation, and hedging are variations of the same basic investment strategy—you are betting that one currency will strengthen or weaken against the other. Not for the faint-hearted, these investments involve more due diligence and savvy than all of the other security types we have covered so far. Trading in Read More…

Precious metals, particularly gold and silver, are attractive investments to many people. But as usual, you must learn to become a knowledgeable investor as precious metals can fluctuate in value as rapidly as common stocksStocks are “equity investments”, which means that individuals who own stock shares of a company actually own part of that company. Read More…

Unlike stocksStocks are “equity investments” which means that individuals that own stock shares of a company actually own part of that company., which are equity instruments, bondsA debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest payments based on Read More…

ETFs are a cross between mutual funds and stocks. ETFs are simply a portfolio of stocks or bondsA debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest payments based on the coupon rate, and eventually repays the borrowed amount Read More…

A mutual fund is a type of investment where a money manager takes your cash and invests it as he sees fit, usually following some rough guidelines. For example, the Fidelity Group has a fund that specializes in finding high dividend paying stocksStocks are “equity investments”, which means that individuals that own stock shares of Read More…

Stocks are “equity investments” which means that when you own shares of a company you own part of that company. For example, if you own 1,000 shares of Apple Computer stock and Apple has 1,000,000 shares that are “issued and outstanding,” then you own 0.1% of the company. If Apple were then to be sold Read More…

With a CDAn investment choice at most banks where you agree to deposit a specific amount of money for a fixed period of time (this is called the maturity). By agreeing to keep your money at the bank for a certain length of time, the bank usually pays you an interest rate higher than savings Read More…

So, you just got your year-end bonus of $2,000. Now what are you going to do with it? Let’s review the obvious choices… Most financial institutions, banks, credit unions, and savings and loan associations have a similar menu of investment products from which you may choose. Here are the most common and popular products: Savings Read More…

The first time Tiger Woods grabbed a golf club he couldn’t hit the ball perfectly straight 300 yards and the first time Michael Jordan touched a basketball he couldn’t dunk it, so don’t think that you will be able to earn a 100% return in the first year. Before Tiger could hit a golf ball Read More…

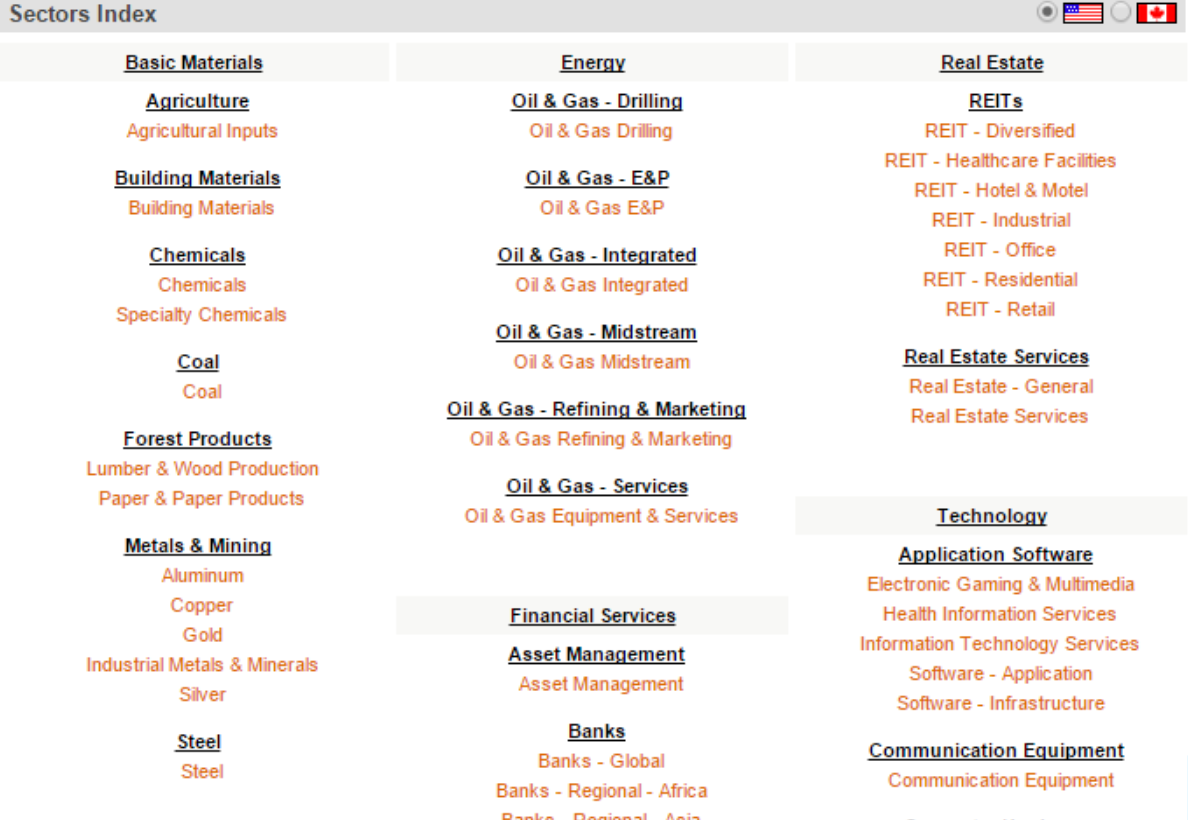

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between various sectors. Click on this post to find out how our Quotes Tool can help you diversify your portfolio.

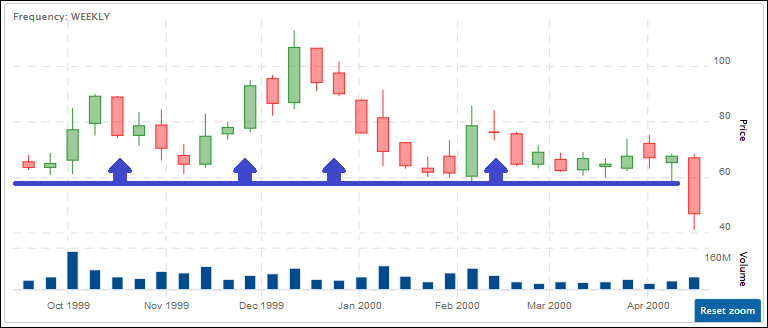

“OHLC” stands for “Open, High, Low, Close”, and this is a chart designed to help illustrate the movement of a stock’s price over time (typically a trading day, hour, or minute).

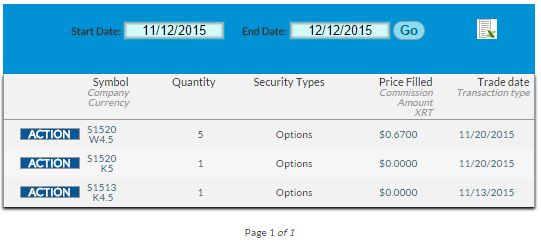

Your transaction history page will show you all the orders you’ve placed that have gone through. Click on this post to learn about its features and uses.

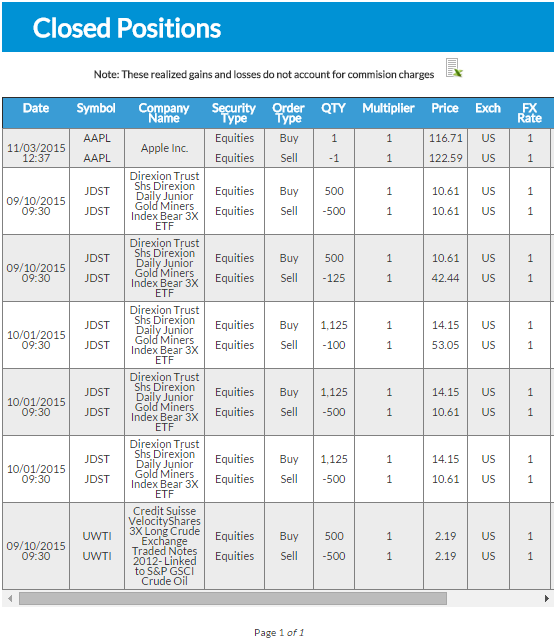

Your closed positions page will show an estimated profit and loss from all positions you’ve “Closed” (bought then later sold, or shorted and later covered. Click on this article to read about its features.

This post will help you locate your Open Positions page!

Our Quotes Page provides a variety research tools both for beginners and for those looking to do more advanced research. Click on this article to learn about the various tools found on the quotes page, and what they can offer.

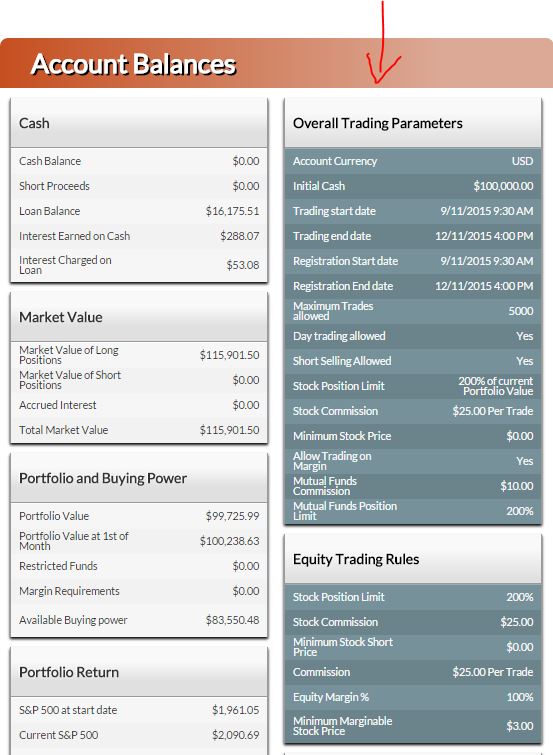

Calculating your buying power can be tricky, and it gets trickier with more complex contest rules. This will be a quick primer on how to see exactly how your buying power is calculated, what affects it, and how to recover it when you want to make more purchases.

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.”

This simple answer is when you have money to invest for an extended period of time, the stock market historically has provided the greatest return. Read this post to understand why.

“Wall Street” is a street in New York City, near the southern end of Manhattan Island. It is the home of the New York Stock Exchange, and the biggest center of stock trading and finance in the world.

The New York Stock Exchange (or NYSE) is the largest stock exchange in the world, where buyers and sellers come to trade U.S. stocks!

ETFs have been one of the most popular investment vehicles in the world over the last decade or so, with investors of all types attracted to the low fees, but diverse holdings. Their biggest strong point, that you can trade them throughout the day like a stock instead of just end-of-day like mutual finds, is also their Achilles heel. Read this article to learn why.

Fibonacci Arcs and retracements are used as a technical indicator to determine support and resistance. As with most indicators it can be used to see if a breakout has occurred or if a reversal is likely to happen.

Forex or (FX) is the term used for the world’s currency market. It comes from the words “Foreign Exchange”.

A Stop (or stop loss) order and Limit order are orders that try to execute when a certain price threshold is reached. These orders are mirrors of each other; they have the same mechanics, but have opposite triggers.

Trailing Orders are an order type that allows to set a moving stop or limit target price.

Your “Risk Level” is how much risk you are willing to accept to get a certain level of reward; riskier stocks are both the ones that can lose the most or gain the most over time.

An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs.

“Asset Allocation” is how you have divided up your investments across different assets. You can have all your assets in one place, or you can use diversification to spread them around to reduce risk.

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. H