Part of Our Summer 2025 Content Update We’re excited to announce a fresh new look for your favorite PersonalFinanceLab assignments! As part of our Summer 2025 Content Update, we’ve updated all assignment titles to make them more engaging, easier to understand, and more classroom-friendly. Whether you’re assigning a budgeting game, stock market simulation, or personal Read More…

As educators, we know how important it is to prepare our students for the real world; and that includes handling money wisely. Credit cards can be tricky for young people, but with the right information, they can learn to use them responsibly and avoid common mistakes. That’s why we’re excited to share this easy-to-understand Credit Read More…

Graduation is a thrilling milestone—but what comes after the tassel flip? Whether students are heading into the job market or continuing education, planning ahead is key. That’s why the “What’s After Graduation?” lesson plan from PersonalFinanceLab is such a powerful tool. Clear options laid out: The first part breaks down the two main paths—entering the Read More…

This project comes recommended from Leesa Hudak from Bow High School in New Hampshire. Learn more about Leesa’s classes in our case study! Objective: Students will build and manage a stock portfolio over the course of a semester, making investment decisions based on research, market trends, and risk assessment. Project Guidelines: Evaluation Criteria: 20 points: 1. Read More…

Opportunity cost is one of the most essential concepts in economics and personal finance—and one of the most useful for students to understand early on. To help bring this idea to life in your classroom, we’ve created a downloadable lesson plan that’s simple to implement and built for engagement. Inside this resource, you’ll find: This Read More…

Interview with Leesa Hudak, a High School Finance and Economics Teacher at Bow High School in New Hampshire. Overview In this case study, we explore how a high school teacher the PersonalFinanceLab Stock Game to deepen financial literacy and economic understanding across multiple classes, ranging from introductory finance to advanced investing. Through long-term simulations, student-created Read More…

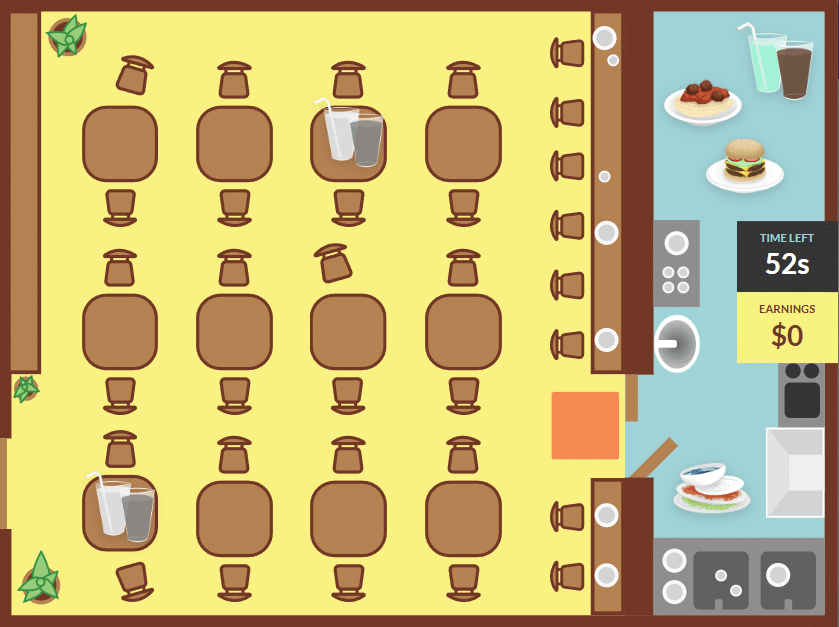

Picking up some extra cash in today’s gig economy is a financial reality that most young adults at least consider at one point or another – and having the option to pick up some extra cash can be a life-saver (and budget savior). Our budgeting game captures this in our Weekend Choice – players have Read More…

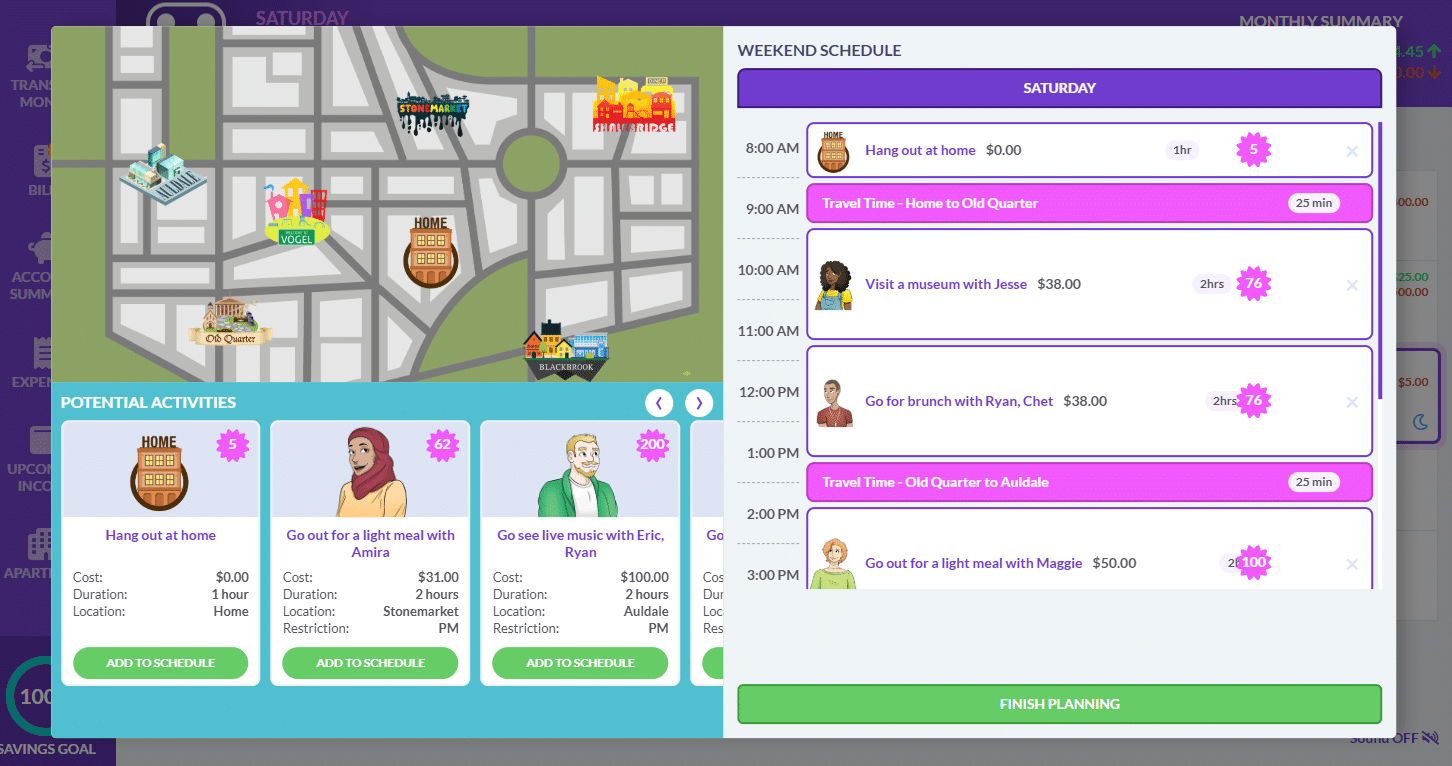

Knowing how to manage one’s time is as important as managing money – which is the cornerstone of our new “Socializing” mini-game in our personal budgeting game! How The Time Management Game Works The Time Management game launches as part of our Weekend Events, triggering when a user chooses to Socialize with their friends on Read More…

When we think of personal finance, it’s easy to box it into one neat academic category: economics. But money—how we earn it, spend it, save it, and think about it—intersects with nearly every part of our lives. So why limit it to just one classroom? By weaving personal finance into subjects across the curriculum, schools Read More…

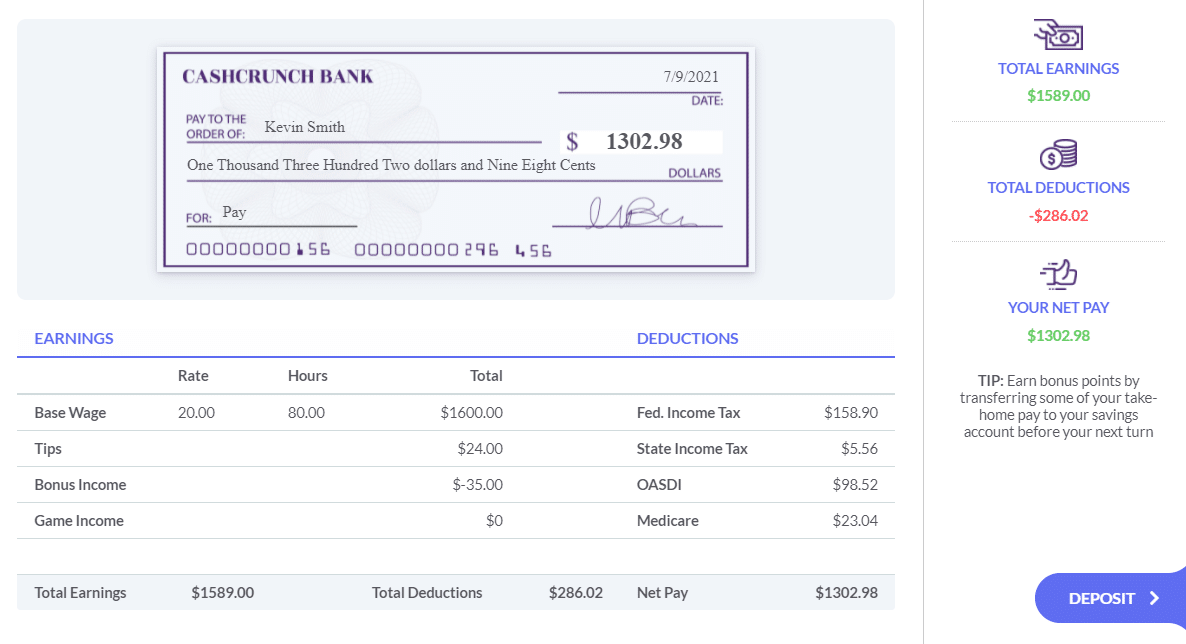

Many students are excited to earn their first paycheck, but it often comes as a surprise when that paycheck is smaller than expected. This is a great opportunity to introduce the topic of taxes in a way that feels relevant to their lives. Why It’s Important for Students to Learn About Taxes For many students, Read More…

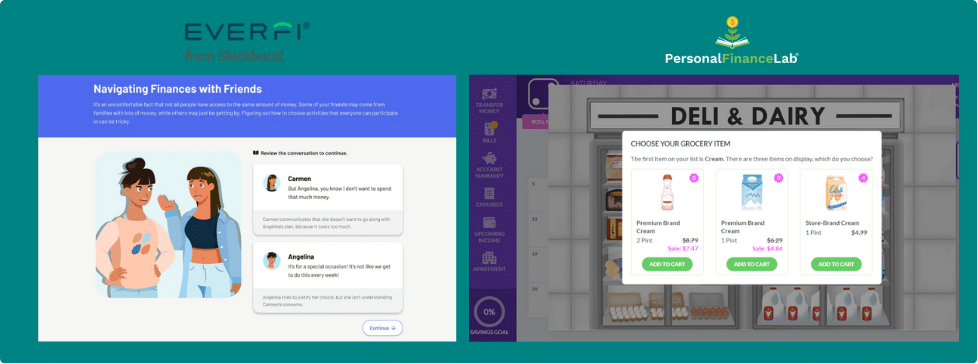

Financial literacy is more than a checklist of topics, it’s a lifelong skill that students must internalize through active engagement, decision-making, and reflection. At PersonalFinanceLab, we believe that the best way to teach financial concepts is by letting students live them — virtually, of course — in safe but realistic simulations that mirror the financial Read More…

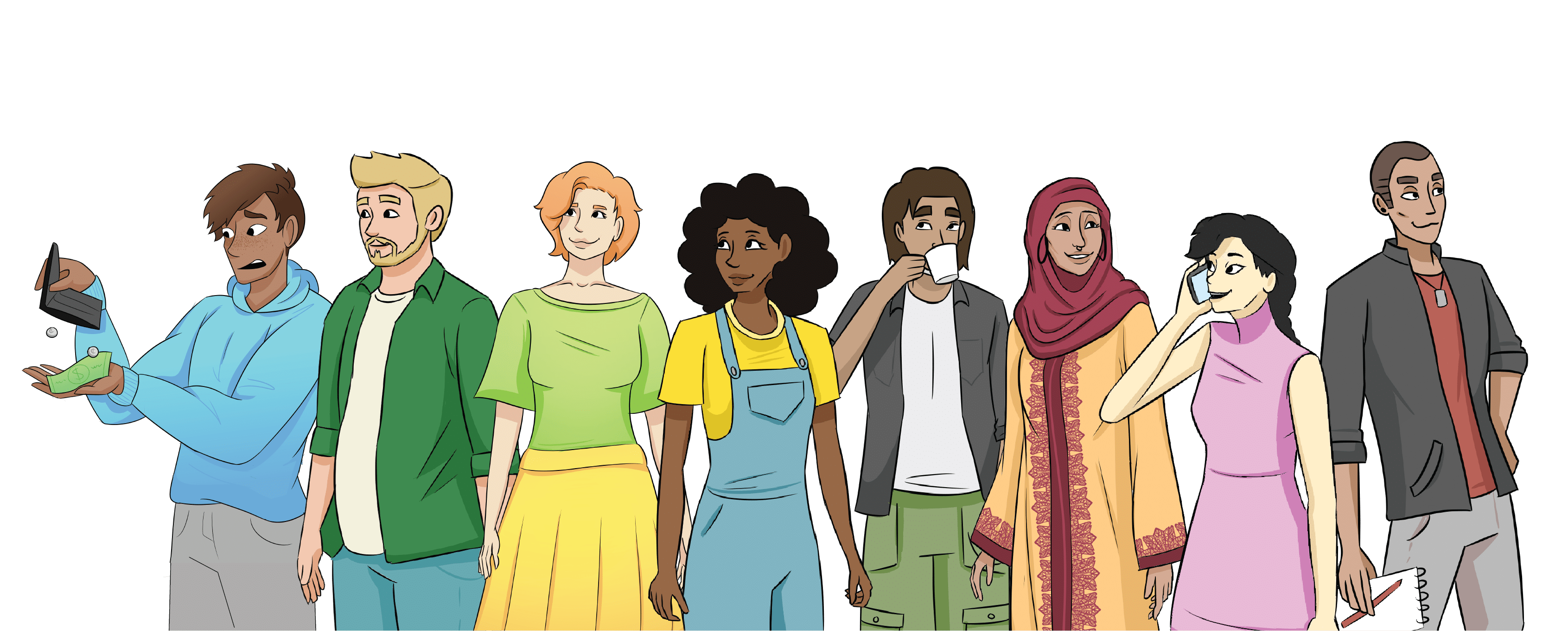

PersonalFinanceLab is all about helping young people learn more about financial literacy, with our animated videos, budgeting game, and stock game working with our lesson library to bring learning to life. To bring these concepts to life, our cast of characters has been showing up across our games, videos, and lessons for the last year. Read More…

Ryan is a charismatic and confident entrepreneur who effortlessly navigates the cutthroat world of high-stakes business deals with his quick wit, sharp instincts, and infectious charm. About Ryan He can be described as: His money habits are: His goals and motivations are: Ryan’s Investing Portfolio Ryan’s investing portfolio is a mix of ETFs and stocks. Read More…

Tia is a meticulous and analytical individual who thrives in the world of numbers and technology, always seeking to optimize her life. She could spend hours doing puzzles or complex math-based games. About Tia She can be described as: Her money habits are: Her goals and motivations are: Tia’s Investing Portfolio Tia’s investing portfolio is Read More…

Maggie is a sentimental and practical individual who values stability and security, often prioritizing comfort and familiarity over adventure and risk. About Maggie She can be described as: Her money habits are: Her goals and motivations are: Maggie’s Investing Portfolio Maggie’s investing portfolio is a mix of ETFs and stocks. Maggie’s ETFs and Mutual Funds Read More…

Jesse is a driven and resourceful individual who embodies the spirit of a true go-getter, always striving to achieve her goals and live life on her own terms. She is athletic and plays competitive volleyball. About Jesse She can be described as: Her money habits are: Her goals and motivations are: Jesse’s Investing Portfolio Jesse’s Read More…

Esteban is fascinated by space since he was a kid. He loves reading and writing science fiction, and his dry sense of humor is loved by his friends and classmates (and tolerated by his teachers). He effortlessly gets good grades. About Esteban He can be described as: His money habits are: His goals and motivations Read More…

Eric is a rugged and energetic handyman who thrives on action and competition, always looking for the next challenge or project to tackle with his hands-on skills and booming personality. He used to play football in school, and now plays recreational softball on weekends. About Eric He can be described as: His money habits are: Read More…

Amira is a creative and empathetic individual who thrives in the world of art and self-expression, always seeking to inspire and uplift those around her. About Amira She can be described as: Her money habits are: Her goals and motivations are: Amira’s Investing Portfolio Amira’s investing portfolio is a mix of ETFs and stocks. Amira’s Read More…

Chet is a laid-back and carefree individual who lives in the moment, often prioritizing short-term pleasures over long-term consequences. About Chet He can be described as: His money habits are: His goals and motivations are: Chet’s Investing Portfolio Chet’s investing portfolio is a mix of ETFs and stocks. Chet’s ETFs and Mutual Funds Invesco QQQ Read More…

April is Financial Literacy Month, and we are celebrating with our 6th annual Spring Financial Literacy Challenge! It ran for the month of April, 2025 About The Challenge The April Financial Literacy Challenge is our annual free world-wide budgeting and investing competition open to all K-12 schools. Students will be challenged to build and maintain Read More…

We hope you are as excited as we are, because we have some major updates for your classes this Spring! From financial math and calculators, to comparison shopping games, to bug fixes and improvements, stay tuned to see what we have in store for your spring classes! If you want to learn more about these Read More…

To celebrate the New Year, everyone here at PersonalFinanceLab is excited to announce our brand-new calculators, available now for all Personal Finance classes as part of our Financial Literacy Curriculum! About The Calculators Each calculator was developed and released to be part of a lesson on financial literacy – this semester we focused mainly on Read More…

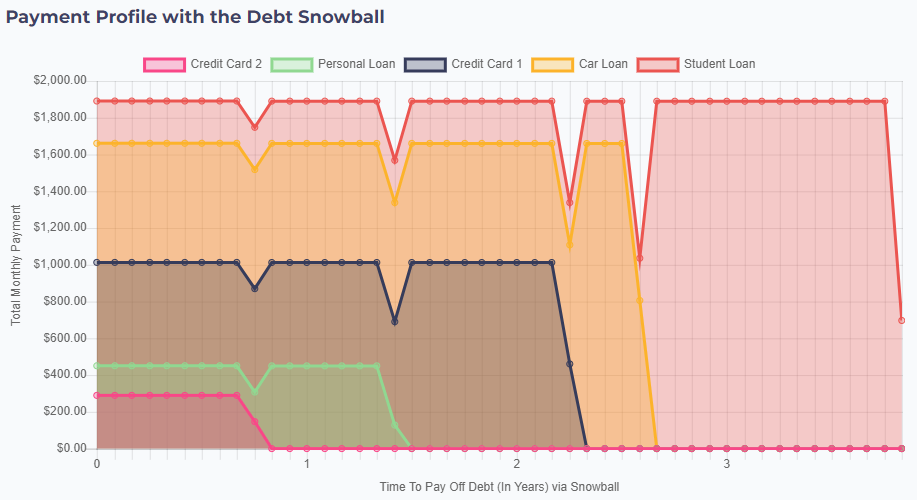

We are excited as ever to announce the latest addition to our Personal Finance Curriculum Library – our interactive lesson on Debt Snowball and Debt Avalanche! What is a Debt Snowball and Avalanche? Debt Snowball and Debt Avalanche refers to two accelerated debt repayment techniques, which can save a person trying to get out of Read More…

Financial math is more important than ever – and we are here to support teachers along the way! These new topics generally build on the more basic lessons in our personal finance curriculum library, with additional complexity and examples to make them at home in a class focusing on financial algebra. About Each Lesson This Read More…

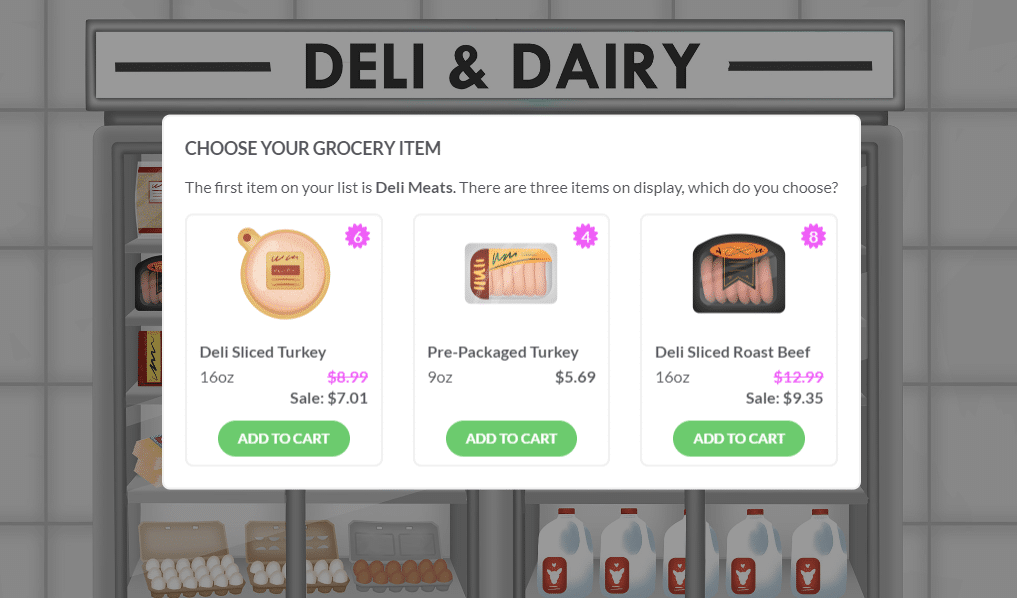

Knowing how to comparison shop for the best deal is a a fundamental skill for every consumer. Different package sizes, different perceived quality, and different prices can be confusing to navigate, especially for young people. This is why we are so excited to add our “Comparison Shopping” mini-game to our personal budgeting game! How The Read More…

In today’s complex financial landscape, Arizona teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Arkansas teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Meeting Arkansas Personal Read More…

In today’s complex financial landscape, California teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Colorado teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Delaware teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

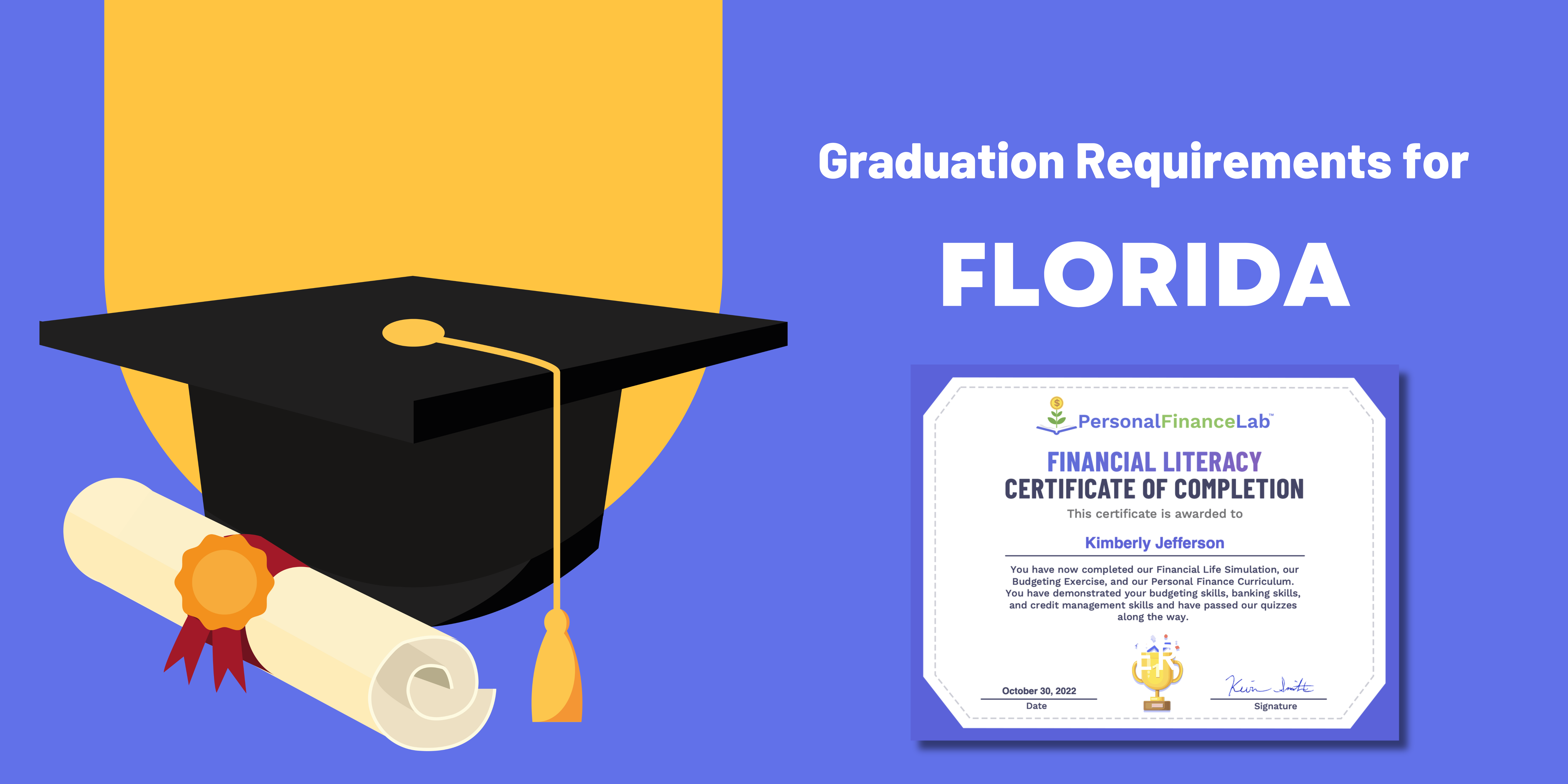

In today’s complex financial landscape, Florida teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Georgia teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Idaho teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Illinois teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Indiana teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Iowa teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Kentucky teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Louisiana teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Maine teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Maryland teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Massachusetts teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Michigan teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Minnesota teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Mississippi teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Missouri teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Nebraska teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Nevada teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, New Jersey teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…

In today’s complex financial landscape, New York teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…