In this lesson students will be learning about different types of scams that could happen over the phone or on the computer. They will be able to identify when they find a scam and will learn the importance of not falling into the scam. Includes 5 customizable activities

This document was part of the lease you signed after moving into your apartment. Lease Terms QUIET ENJOYMENT: Tenant shall be entitled to quiet enjoyment of the Premises and Landlord will not interfere with that right, as long as Tenant pays the rent in a timely manner and performs all other obligations under this Lease. Read More…

The world’s best tool for teaching Personal Finance, Economics, and Business is about to get even better with our new customizable Budgeting Game! How It Works Schools with a site license for PersonalFinanceLab.com stock and budgeting games will now have the option to also add our new customizable budgeting simulation to their class, and Read More…

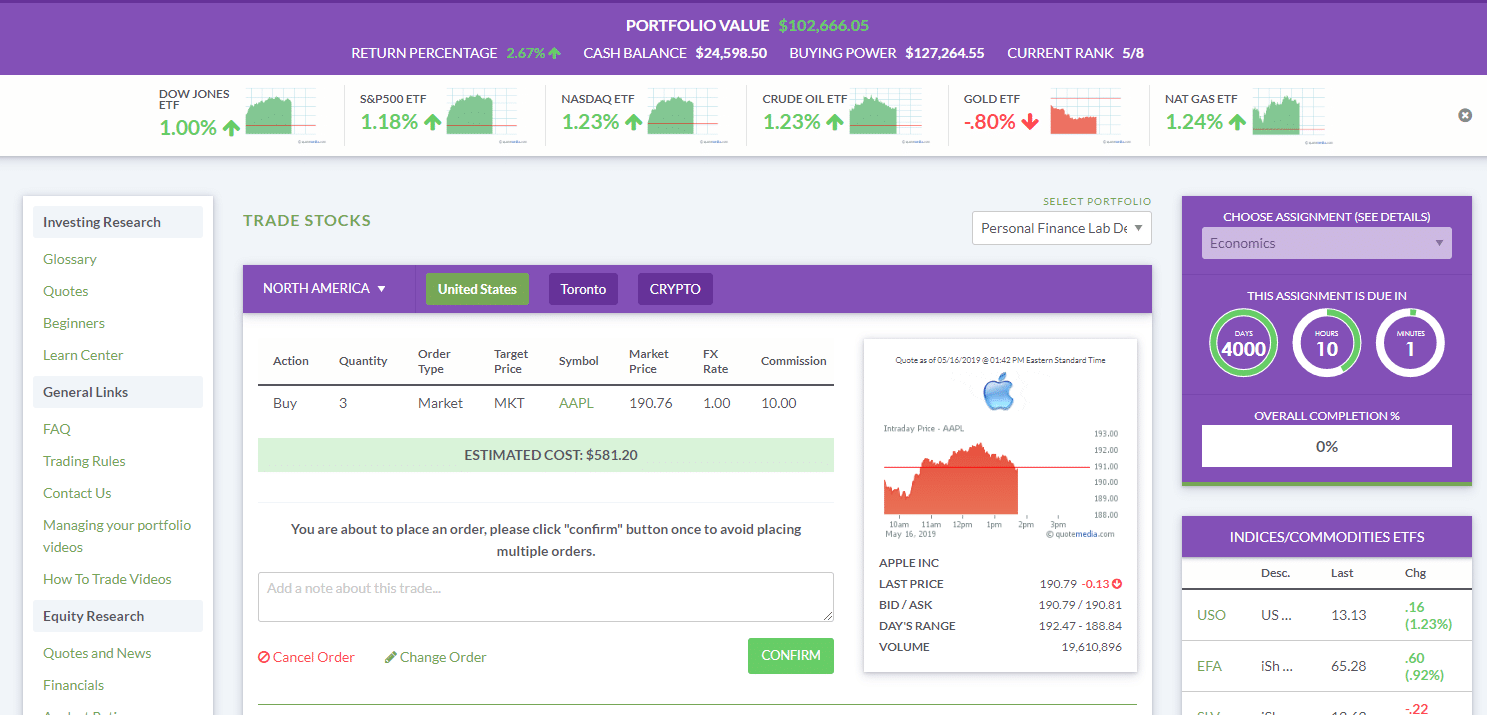

Teachers sometimes ask us why we anchor the curriculum and other activities on PersonalFinanceLab.com to our stock market simulation – so we want to tell you why! Research Tested, Student Approved There are numerous studies showing how stock market games improve classroom outcomes in Personal Finance, Economics, and Business classes, with a body of literature Read More…

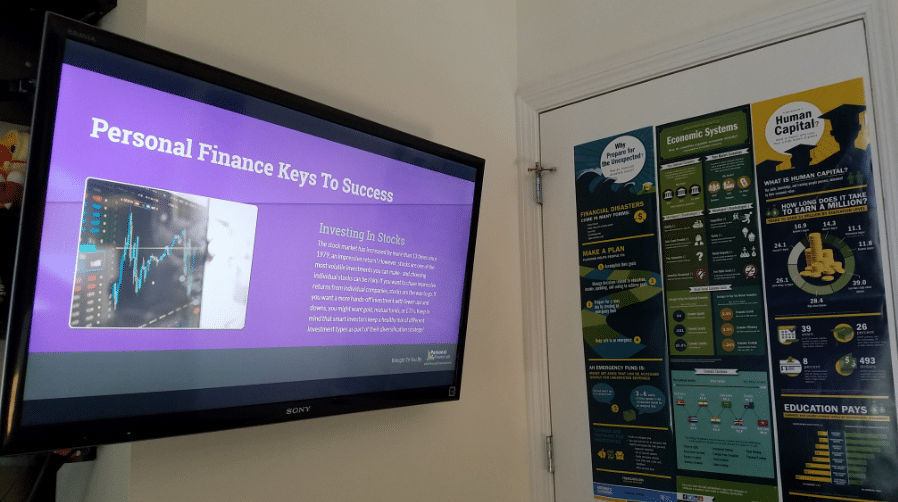

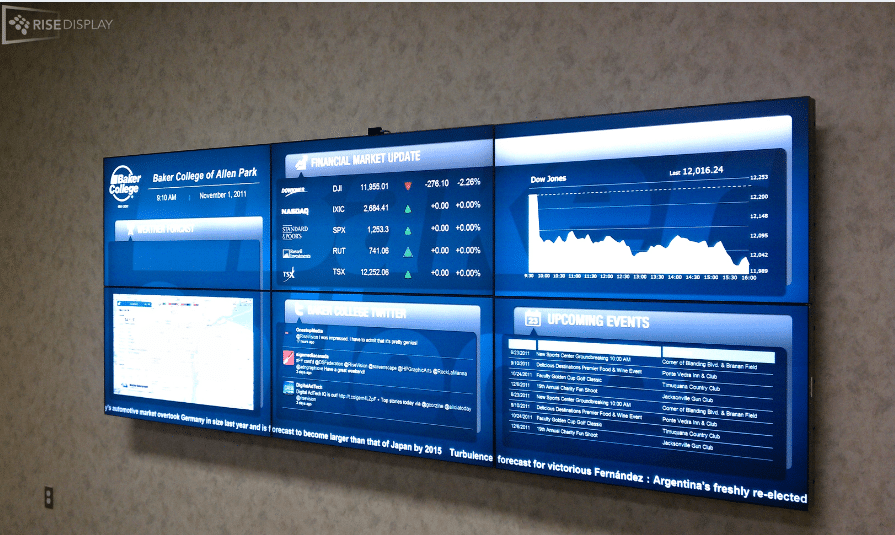

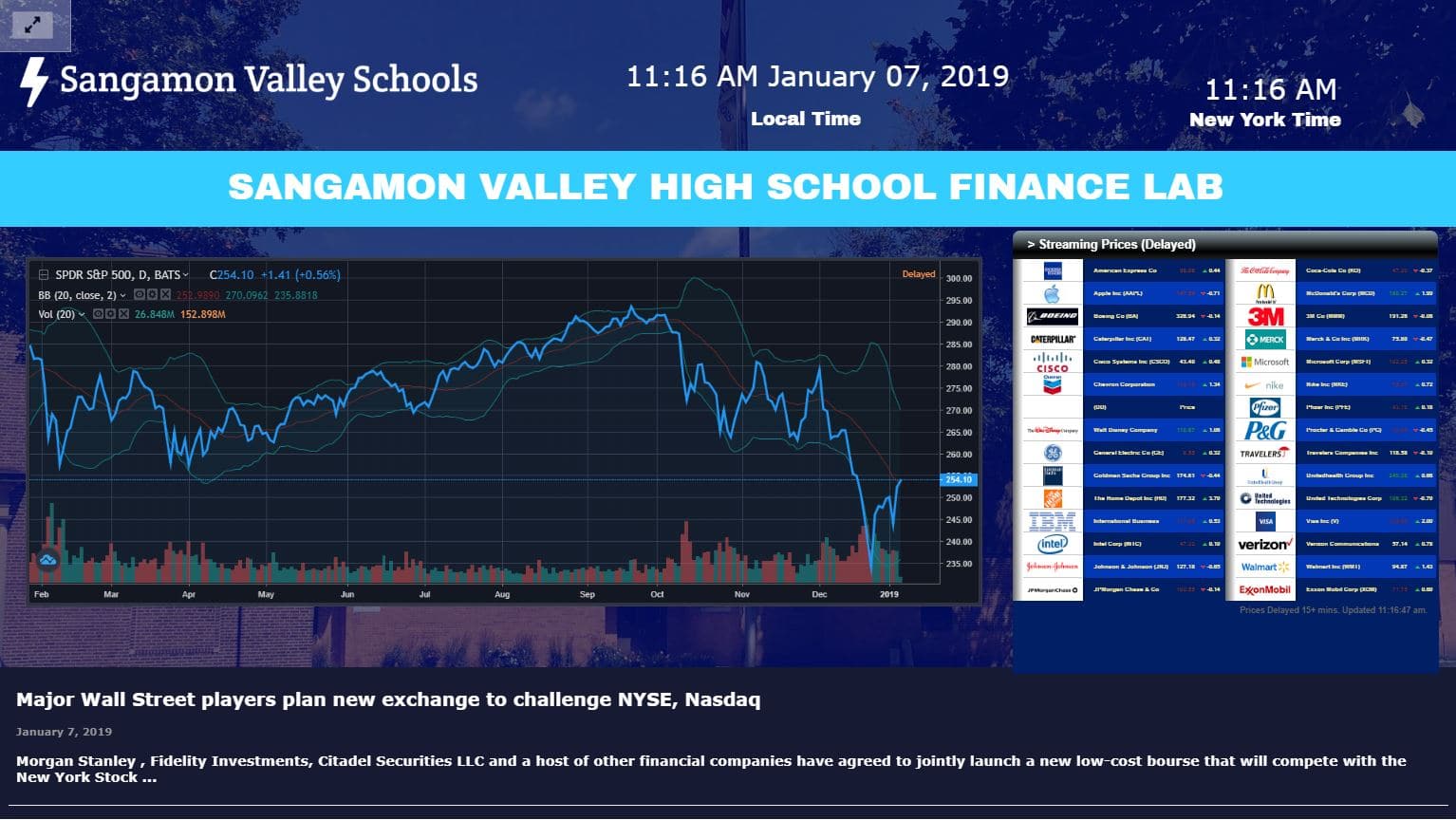

Marquette Catholic High School in Michigan City, Indiana was one of the first schools we worked with to transform one of their classrooms into a full Financial Literacy Lab. The Marquette program utilizes the Personal Finance Lab simulation and curriculum both in their Economics classes and their Global Trading classes, focused on investing and finance. Read More…

We work with hundreds of schools around the country to take their Personal Finance, Economics, and Business classes to the next level. Over the last few years, more and more schools are using our Personal Budgeting Game, our customizable Stock Market Game, and our curriculum library to start building Finance Lab. Eventually they add on Read More…

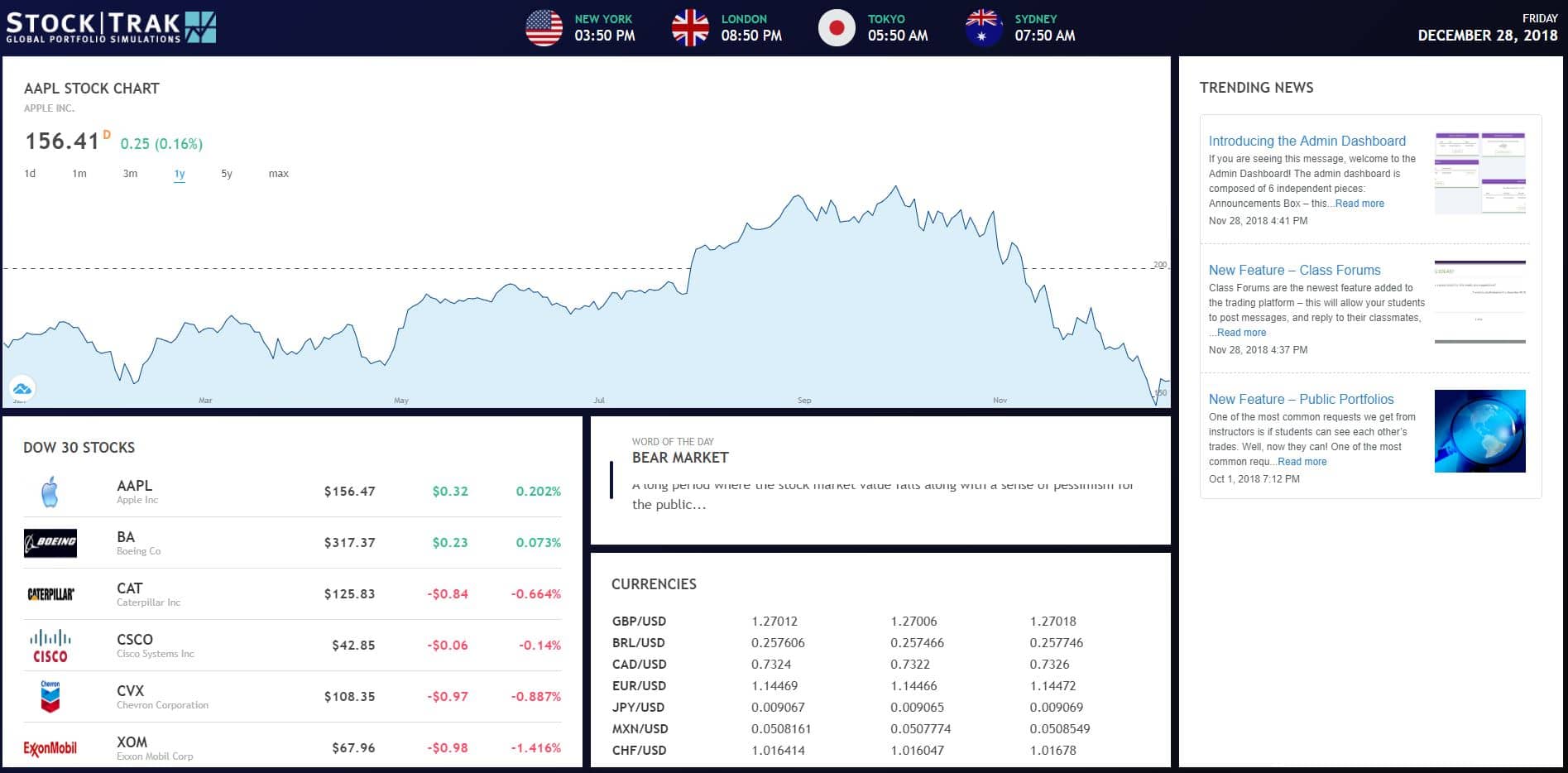

The MarketInsight display is one of the fundamental pieces of any Finance Lab. This is an LCD screen that can rotate several financial “widgets” for your classes. The coolest part is that each MarketInsight is fully configurable – you choose what you want displayed! How Does It Work? Think of your MarketInsight like a PowerPoint Read More…

Cost is the biggest barrier preventing teachers from launching their first lab. Getting quotes from vendors, applying for grants, getting administration approval (on top of planning and running your classes!) puts up a huge wall between your students and the awesome financial literacy resources they deserve. To help break down this barrier, we’ve put together Read More…

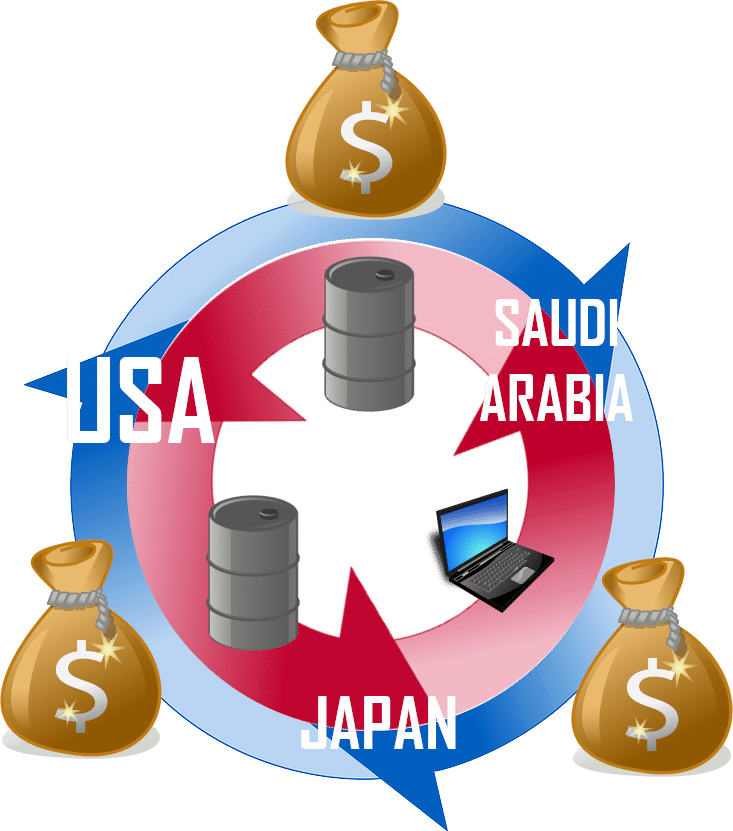

Comparative Advantage is the term used to describe how one person, business, or economy, is able to outproduce one product or service compared to another person, business, or economy.

Having trouble knowing how to communicate your raw portfolio data, into consolidated, comprehensible reports? Look no further. This article details step-by-step instructions on how to use Excel to to graph your portfolio’s values.

The most important reason you would want to use excel to track your stock portfolio is trying to calculate your profit and loss from each trade. Read this article to step-by-step instructions on how to calculate your profit and loss using Spreadsheets.

If you’ve been trading for a long period of time you might have been curious to know what your daily returns were. Excel and Google Sheets can help you efficiently calculate this in a simple way. Suppose we started trading on August 29th, 2017. It is now September 7th and we would like to know Read More…

Before you can consider creating graphs to demonstrate your portfolio values, or calculating the profit and loss of your trades, you need to import data from your portfolio into a spreadsheet, and make some sense of these numbers. Read this article for guidance on how to export data from your portfolio into excel successfully!

Gross Domestic Product (GDP) is a measure of the total economic output a country makes in a given year, and indicates the total size of the economy. Want to learn about how it is calculated? This article will answer that question, and more!

Personal Finance Lab was designed as a simple and effective resource for teachers. Click on this post to find out just how easy it is to use!

If you can save just $100 per month, you might struggle to decide between putting your money in a savings account, or investing in the stock market.

If you can find a savings account that gives a 3% rate of return, after 10 years you will have saved up $13,980. $12,000 is from cash deposits, and $1,980 from interest.

If you invest in the stock market at the average growth rate of the S&P 500, after 10 years you will have saved up $19,620. $12,000 is from cash deposits, and $7,620 from interest.

Make your money work for you!

The best time to start saving is NOW!

If you can start saving and investing just $110 per month when you turn 18 earning the standard market rate of return, you will have saved up over $1 million by the time you turn 65. This amounts to saving just $62,000 – letting compound interest and the markets do the rest.

If you wait until you are 25 to start saving, you’ll need to increase your monthly savings by $90 per month to reach the same goal – saving up a total of $96,000.

By waiting, you will need to save an extra full year of wages just to reach the same goal! Start saving now, for huge returns in the future!

Saving a million dollars is easier than you think!

If you can invest just $200 per month starting when you turn 18 and earn the average market return, you will have saved up over a million dollars when you turn 58!

It also keeps growing – you will have over $1,800,000 by the time you turn 65 – letting you spend over a hundred thousand dollars per year while your investments continue to grow in retirement!

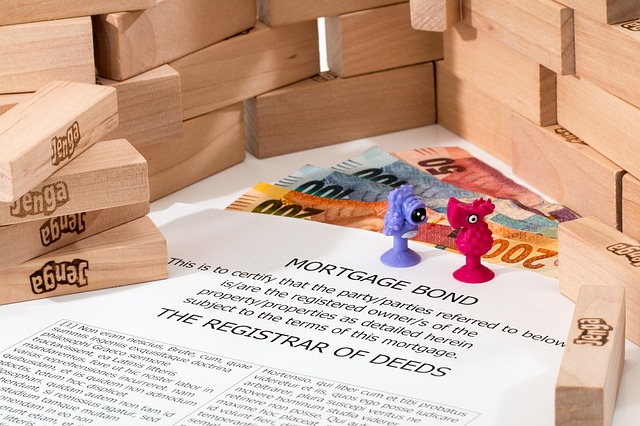

Bonds are a loan you can make to governments, and they will pay you back regular interest payments. At the end of the bond term, you will also get back the loan amount.

Bonds are very low-risk investments, but also tend to be very low reward (typically not much more inflation). These are a great way to invest if you are unsure about the stock and commodities markets.

Exchange Traded Funds (or ETFs) are investment funds with a lot in common with mutual funds. Instead of being managed by a professional Fund Manager, ETFs are designed to replicate the movement of some other index, such as the S&P 500, or follow the price of oil. These can be used both to diversify a portfolio and to invest in things like commodities, which do not normally trade on the stock exchange.

ETFs are a good way to invest in a broad range of investments all at once, such as broadly investing in Biotech stocks. They can also be used to “Go Short” on a broad index, or even use a Leveraged ETF to double the gains (or losses) of whatever it is tracking!

If you want to diversify but don’t know where to start, the answer might be mutual funds!

Mutual funds are professionally-managed investment funds that you can invest in. Once you invest, a professional Fund Manager will use your money across a wide range of vehicles, which can include stocks, bonds, currencies, commodities, and more. Each mutual fund has its own investment goals and guidelines (and different balances between risk and reward).

The stock market has increased by more than 13 times since 1979, an impressive return! However, stocks are one of the most volatile investments you can make – and choosing individual stocks can be risky.

If you want to chase impressive returns from individual companies, stocks are the way to go. If you want a more hands-off investment with fewer ups and downs, you might want gold, mutual funds, or ETFs.

Keep in mind that smart investors keep a healthy mix of different investment types as part of their diversification strategy!

The price of Gold generally goes up when the markets go down, as investors think it will hold its value if stocks start to fall.

Since 1979, the S&P 500 grew 13 times faster than the price of Gold. However, during the last market crash, Gold almost doubled its price (from its lowest to highest points), while the S&P 500 lost half of its value (from the highest to its lowest point).

If you are worried about a stock crash, gold might be a good place to invest. If you think the stock market is strong, stick to stocks, mutual funds, and ETFs!

The first step to starting a budget is to understand how you spend your money NOW.

For the next month, write down absolutely everything you spend your money on – from school lunches to cups of coffee to clothes, and everything in between!

At the end of the month, take a look at all your spending, and try to categorize it (Food, Clothing, Transportation, ect). This will let you see what you are spending now. Now you can decide if you are happy with your current spending, or if you want to set different goals for next month!

A “Spending Plan” is similar to a budget, but a bit easier to manage and follow. With a spending plan, you will not try to allocate every dollar of your income to either saving or spending, but set a general guide on how much you usually spend for different things.

By setting aside your savings before even looking at your other expenses, most people find it much simpler to stay under budget!

If you have income and expenses, you need a budget! Budgets are living tools that you can use to visualize how much you spend every month, and are essential to setting and meeting your savings goals.

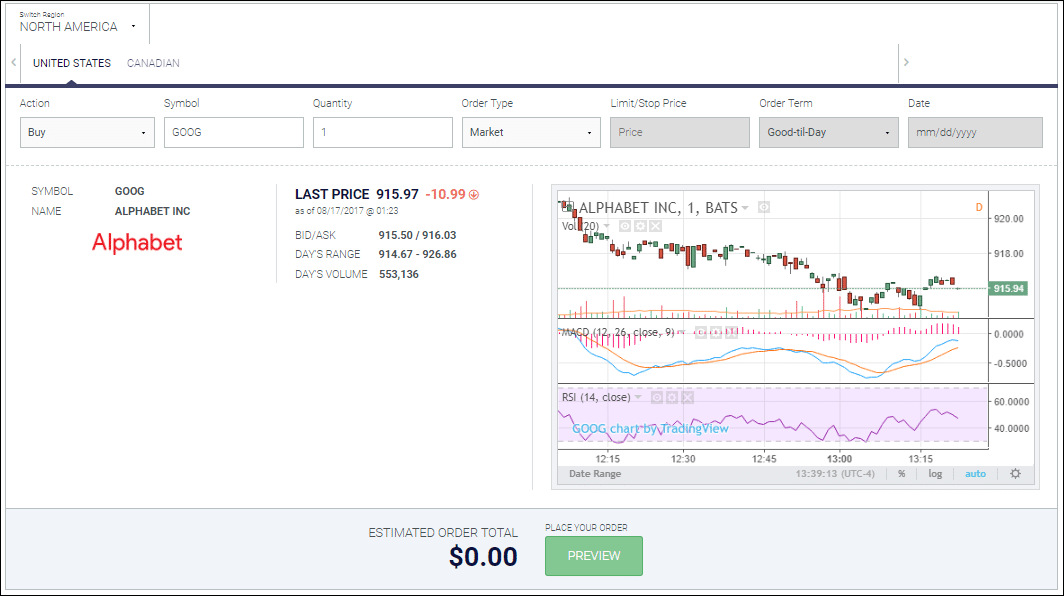

A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Read this post to learn about the components of a long stock, and what it looks like graphically.

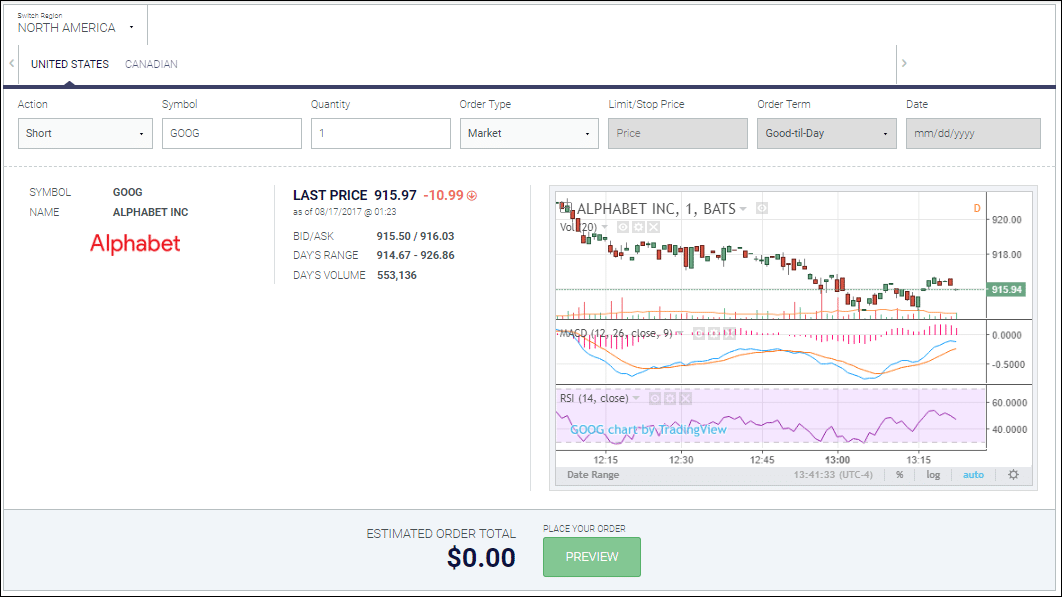

A short stock is an expression used when you sold shares of a company that you did not own beforehand, and is described in more detail in this post!

How To Build A Portfolio: Video and Quiz!

Open this post to see a video that explains what an index is.

Click on this post to see the “What is a Stock Market?” video!

This post contains an informative video titled “What Are Bonds?”.

Click on this post to learn about what mutual funds are with an video!

Click on this post for a video on “Stocks Made Easy”.

One area of accounting is cost accounting, which focuses on internal reporting for the purpose of improving managerial decision making. Key concepts include cost allocation, cost-volume-profit and the role of a double break-even!

Risk is one of the most important concepts in investing, economics, and personal finance, yet very few people really understand just how big a role risk plays in our everyday lives. Risk plays into insurance, investing, savings, and much more!

“Property Rights” usually refers to a set of fundamental rights giving citizens control over their own land, capital, and ideas. Property rights is the foundation of all free-enterprise economic systems. It is what allows people to profit from capital and ideas, without fear of seizure by the government or theft.

The government has two main ways it tries to influence the economy – through Fiscal Policy and Monetary Policy. Montetary policy involves the government directly injecting cash into the economy through government spending.

International Trade is the system under which businesses, individuals, and governments trade goods and services. This exchange from many different National economies is what makes up the Global economy. This is impacted not just by the supply and demand of goods, but the supply and demand of currenies, and the laws and policies of the different governments

“Inflation” means that the general prices of goods and services goes up from one year to another. There are a few ways to calculate inflation – from a simple “basket of goods” compared over time, to complicated economic models looking across thousands of factors

In any society with a market-based economy, the government must: ensure the common defense, promote economic growth, and strive to maintain a just society. All three of these tasks are related to the economy in one way or another, meaning everything the government does will have an impact on the economy.

The way the government organizes taxes and their spending to influence the economy is called the Fiscal Policy. Fiscal policy is controlled by congress and the president, and boils down to how they adjust spending federal money to encourage economic growth

The Time Value of Money is a concept that a dollar in your pocket today is worth more than a dollar tomorrow – because you can use it right away. The time value of money is determined by interest rates and opportunity cost – what else could you be doing with that money?

See our collection of personal finance, economics, investing, savings, business, math, and social studies lesson plans to kick start your class. Includes over 50 lesson plans ranging across every grade level, with suggested class activities and ways to integrate the stock game and other learning resources, both for in-class activities and homework.

If you would like to set-up your Market Insight Widgets on any display screens in your classroom, this tutorial will walk you through the first set-up! Prefer “Text and Image” guides? Keep reading! What You Need To get started, there’s a few things you’ll need: A Smart TV with a web browser If you have Read More…

This is a library of Google Slides and PowerPoint presentations designed to accompany lessons built into the Personal Finance Lab assignments.

“Building Wealth” combines exercises from budgeting, spending plans, savings strategies, credit cards, and all points in between in a life-long strategy to build financial security

Raising a family is expensive. According to CNN, it costs over $230,000 to raise a child from birth to age 17 in the United States! Some say that no one is ever prepared to be a parent until it happens, but with a bit of wise financial planning, you can at least worry a bit less about money during the journey.

Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called a “Mortgage”, that breaks the principle and interest into equal payments over the entire term of the loan.