Congratulations on playing our financial life simulation and completing all of our lessons. We now invite you to make the transition from the simulation accounts to real world accounts… Where are you on your financial journey? We’re ready to give you personalized, face to face guidance in a safe environment* at a time and location Read More…

Whether we like it or not, April 15 comes every year and that means our Federal taxes are due. The average taxpayer spends over 10 hours preparing their taxes. To reduce the burden of getting organized and preparing your taxes, it is important to stay organized and know what documents and forms you will need Read More…

Congratulations! You will soon be graduating from college and negotiating your various job offers. You have worked hard to graduate and you deserve a great paying job. But as you start to negotiate your offers, keep in mind that you really should be considering the overall compensation package. Salary is important, but so are things Read More…

A survey of the Class of 2019 showed that 69% had some form of a student loan. While most student loans require you to start making payments within 6 months of graduation, there are certain instances where you can defer these payments. Click on the image below to watch a brief video that explains the Read More…

Shopping for a new car is always a fun day. But negotiating the final price and your payment method with the car salesman can be a dreadful and a challenging task. So, just like going into a final exam, the more prepared you are the easier it is. Click on the image below to reveal Read More…

It’s a tough trade off that we all consider at some point: To buy a used car and save money, or to splurge and buy a new car. Buying a used car is obviously cheaper, but generally new cars are more reliable and get better gas mileage. So what factors should you consider and how Read More…

Saving money is easier than you think and you will learn from this video how to get started and you will see how quickly it starts to add up. Click on the image below to reveal 5 money savings tips when you travel. A short Pop Quiz follows below the article. CLICK HERE TO READ Read More…

We all know how to buy coffee at a coffee shop. You swipe your debit or credit card and the barista hands you your coffee. Some of us have gone through the process of buying a car. You spend an hour negotiating price and then another 15 minutes signing paperwork. But what’s involved in buying Read More…

If you have done your “rent a house” vs. “buy a house” analysis and you have decided to buy a house, your next thought should be “how much can I afford to borrow to buy my house?” The answer is easy—it depends! 🙂 It depends on a lot of factors, so click on the image Read More…

Thinking of buying a house? If you are like most people, then you will need to borrow money to buy that house. So get ready to start negotiating with different mortgage lenders. Click on the image below to review the 10 questions you should ask your mortgage lender. A short Pop Quiz follows below the Read More…

Once you have settled down after college and decided where you plan to live for a few years, you will be faced with the question: Should I continue renting or should I buy a house? While there can be lots of pride in home ownership, it is not without hits drawbacks. The following video walks Read More…

Saving money is easier than you think and you will learn from this video how to get started and you will see how quickly it starts to add up. Click on the image below to reveal 5 money savings tips when you travel. A short Pop Quiz follows below the article. CLICK HERE TO READ Read More…

Over 55% of Americans with credit cards have credit card debt. The younger you are, the more likely you have a credit card balance that you carry every month. If you carry a credit card balance month after month, paying off that debt is easier than you think if you follow some simple rules and Read More…

If you are carrying credit card debt month after month you should know the interest rate that you are being charged on your unpaid balance. If that rate is in the double digits, you can probably save money by transferring that balance to a lower rate card. This strategy is almost a no-brainer, but you Read More…

If you carry a balance on one or more of your credit cards, you will definitely want to review this article. Click on the image below to reveal 4 ways to pay off your credit card debt fast. A short Pop Quiz follows below the article. CLICK HERE TO READ THE REST OF THIS ARTICLE Read More…

Your credit score will affect many segments of your financial life. It will determine if you get approved for a car loan or a mortgage to buy your house. If you get approved for either loan, it will also impact the interest rate you get charged. So get to know your credit score, and click Read More…

Did you know that with most credit cards, if you pay the minimum required monthly payment you will end up paying more in interest than what you paid for your original purchase? THAT is exactly how banks make money and that is why the retail industry promotes the use of bank credit cards and company-branded Read More…

Have you ever wondered how the interest that is charged on your credit card is actually calculated? If you understand a little of the credit card company’s math, you can save yourself lots of money over your lifetime by realizing EVERY DAY counts. Click on the video image below to see a simple example of Read More…

It seems like a Catch-22. How can you start building your credit if you don’t have any credit to start with? Well the truth is most banks will give college students and young adults a credit card with a very low credit limit. Then, if payments are made on time for the first few months, Read More…

Once you have established credit with a bank or credit card company, it is important that you continue to build your credit history and that you keep it healthy. Click on the video image below to reveal 5 things you can do to help build a healthy credit score and avoid common mistakes. A short Read More…

Most studies show that over 70% of Americans own at least one credit card and carry it with them when they go shopping. Other studies show that most Americans carry an average balance of $6,200 on their cards and pay interest every month, but they DON’T know what the interest rate is that they are Read More…

OK, so you got your first credit card. Then all of a sudden your mailbox is full of other banks and brands offering you a credit card. These offers tease you with 10% off discounts when you open a new credit card account. It sounds tempting. But if you are just starting to build your Read More…

Saving money is a lot easier than you think. The first question you have to ask yourself when you are thinking of making a purchase is: “Do I NEED this or do I just WANT it?” Stopping at your local coffee shop every day and spending $2.70 for coffee for 270 days a year adds Read More…

Everyone needs to take a vacation every now and then. Or at least travel to visit family and friends. But for most people who aren’t full-time sales people who travel every week, travelling can be an expensive ordeal. The good news is that it doesn’t have to be. If you know some of the secrets Read More…

Here is one of the most common questions that people who are trying to get control over their finances ask: If I have a little extra cash, do I pay down debt or do I put the money in my savings account? On one hand financial advisors tell us to stop paying high interest rates Read More…

Creating (and staying on) a budget is easier for some people than others. Watch this video to get more ideas on how to simplify your budgeting process and make it easier for you to reach your financial goals. Click on the video image below to get started. Pay close attention to the video as a Read More…

Over time, our society moved away from paying for goods and services with gold and silver to paying for things with cash. In the last two decades, we have been transitioning from paying for things with cash to credit and debit cards. While these 2 cards may look the same, their features and uses are Read More…

Hopefully by now you have a real checking account that you use to manage your monthly cash inflows and outflows. But are you really using all the features that your checking account offers? While there are lots of negatives associated with a checking account, likes ATM fees and overdraft charges, there are lots of really Read More…

Now that you are getting used to managing your checking, savings and credit card accounts as part of this virtual platform, it is time you think about opening real banking accounts. But where do you begin? What questions do you need to ask a bank to make sure you are getting the right accounts for Read More…

As you learn to save, become more aware of your personal finances, you will find yourself accessing your checking, savings, and credit card accounts more and more. While most banks and credit card companies are willing to open up accounts for you for free, keep in mind that every company has to make money some Read More…

As you learn to save and become more aware of your personal finances, you will find yourself accessing your checking, savings, credit cards and other accounts online or via your mobile phone. This means bookmarking your banks URLs, installing their mobile apps on your phone, and inevitably the hassle of remembering all of your logins Read More…

Once you get in the habit of saving money each month, the next question is where exactly to you put the money you are saving? The obvious choices are to keep it in cash in your piggy bank at home or put it in a bank account. Well here is a secret… Instead of keeping Read More…

We all know that we should be saving money. We have all heard the saying from Benjamin Franklin that “a penny saved is a penny earned.” But it seems that it is just so much easier to SPEND money than it is to SAVE money. So how do we get started saving money? Ahh….. That Read More…

At some point in your life you might find yourself in a situation where you need some cash quickly. For example, you might have a doctor bill you need to pay. Or you might need to get your car repaired so you can get to work or you might have a rent bill or a Read More…

Teachers Have Already Claimed Over $250,000 of Student Accounts of PersonalFinanceLab.com’s Personal Budget Game and Stock Market Game. For Immediate Release (Montreal, Quebec) April 24, 2020 – In response to teacher and parent demand for its online educational services, Stock-Trak Inc., the leading provider of educational personal finance games, is now offering access to its Read More…

CashCrunch 101 Expands Company’s Educational Personal Finance Simulations For Immediate Release (Montreal, Quebec) May 8, 2019 – Stock-Trak Inc., the leading provider of virtual stock market trading applications for the education and consumer markets, has recently acquired a personal budgeting simulation (CashCrunch 101) from Fortune and Venture, LLC. “The addition of a customizable personal budgeting Read More…

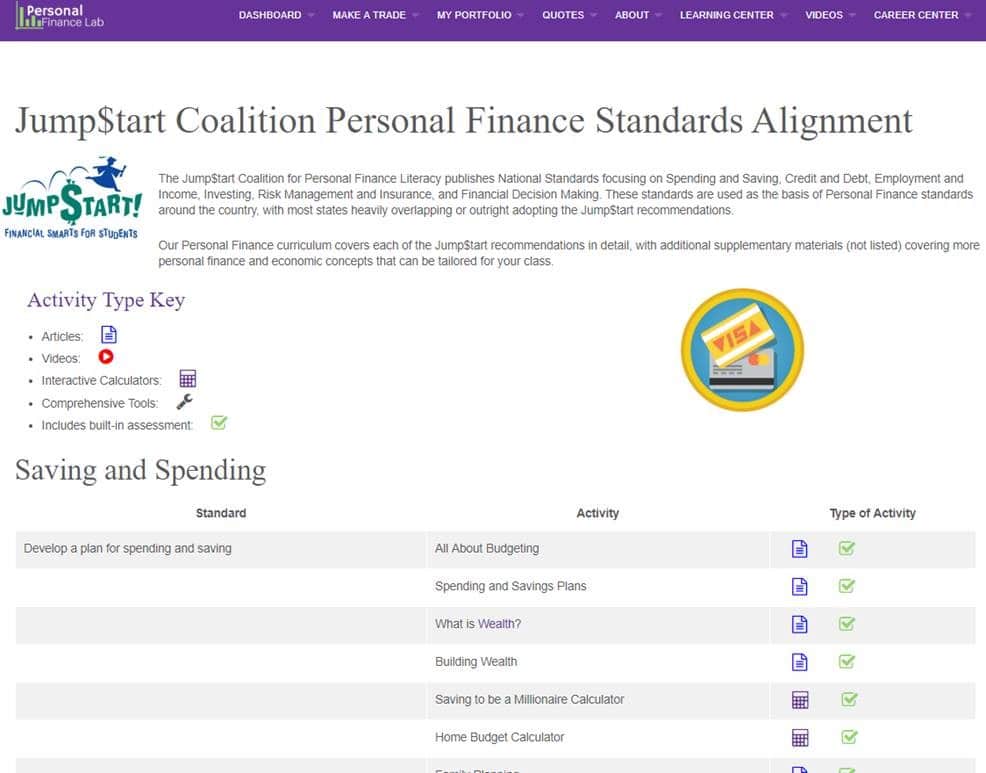

There are several popular stock market games available to high school teachers; but only PersonalFinanceLab.com embeds curriculum specifically aligned to the JumpStart Personal Finance Standards. Read this post to find out how!