A portfolio is a collection of assets that contribute collectively to an overall return.

There are many different reasons you could create a portfolio, and you need to define your reason or objective from the very beginning before adding stocks and other securities to your account.

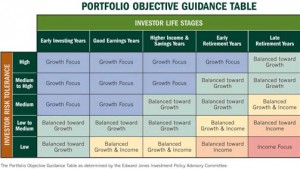

How you would define the objective of your portfolio depends on your time frame and your risk-tolerance.

The following table gives a good representation of portfolio objectives dependant n the two factors:

Source: www.edwardjones.com

What should I buy?

Now that you have determined what your investment objective is, you can decide on what assets you need to buy for your portfolio. You can choose from within stocks, bonds, derivatives and alternate investments.

Before you choose what you want to buy, however, you have to ascertain whether the portfolio will be actively or passively managed.

Stocks

Within Stocks, you can choose in between many different types, a few of which are:

- Blue Chip: These are mature, stable companies that are well-known globally and generally pay good and timely dividends. You would buy these for a Balanced Growth and Income Portfolio.

- Penny Stocks: These are highly volatile stocks that trade more on supply and demand than market news. You would buy these if you are completely growth focuses.

- Market Cap: You can purchase stocks according to their market capitalization, which basically gives an idea as to what stage of the life-cycle t is in. A smaller market-cap stock would generally be bought for a Growth Focused Portfolio, but a Large Market Cap company stock would be bought for Income purposes.

Bonds

Bonds are fixed-income instruments, which basically means that they pay a certain amount periodically. These are perfect of an income based portfolio.

One has to be careful with this assumption because not all bonds have the same risk and hence bonds with higher risk, and subsequently lower ratings, could be bought for a growth portfolio due to its price volatility.

Derivatives

You can make use of derivatives such as options, futures and swaps in your portfolio for both income and growth reasons. If you are being speculative, then you would use it for a growth portfolio, whereas if it is for hedging, you would use it protect your income portfolio.

Alternative Investments

The biggest alternative investment out there is real estate. You can buy a rental property for income purposes, or you could be more speculative and buy land in foreign countries to capitalize from capital appreciation in a growth portfolio

How to put it Together

The percentage of your portfolio value that is invested in certain types of assets described above dictates which objective your portfolio has met.

For example, 50% in growth assets and 50% in income assets leads to a “Balanced Growth and Income Portfolio”.

Adjusting the percentages up and down changes the direction and objectives of the portfolio.

Conclusion

Now you have an idea as to how to go about setting up a portfolio. The main point to take away from here is to know what the objective of your portfolio is based on your risk tolerance and time-frame, and then to start filling up the portfolio with income or growth assets according to the percentages you need to maintain.