Registration is not required for teachers with a paid site license. Students using PersonalFinanceLab will be invited to join the challenge through a pop-up when signing in.

If students choose to participate, the National Challenge becomes available while playing the Stock Game or Budget Game, in addition to their regular class. They can switch between the National Challenge and their class anytime. Participating students can earn badges in the National Challenge, which will also apply to their class! They will also have the chance to win prizes.

Any other teachers at your school or district can participate in the challenge, free-of-charge! If there is anyone you know that might be interested, please send them this link with all the details of the challenge.

Learn more

Prizes Total of

The top 3 students from both the Budget Game and Stock Game in each region will each win a $50 Amazon Gift Card. Plus, the top 3 overall winners for each game win an additional $50 Gift Card!

Prizes Total of

3 teachers will receive a $100 Amazon Gift Card. Students can nominate their teacher, and we’ll pick 3 lucky winners who will each get a $100 Amazon Gift Card. Plus a free PersonalFinanceLab site license for 100 students for one year.

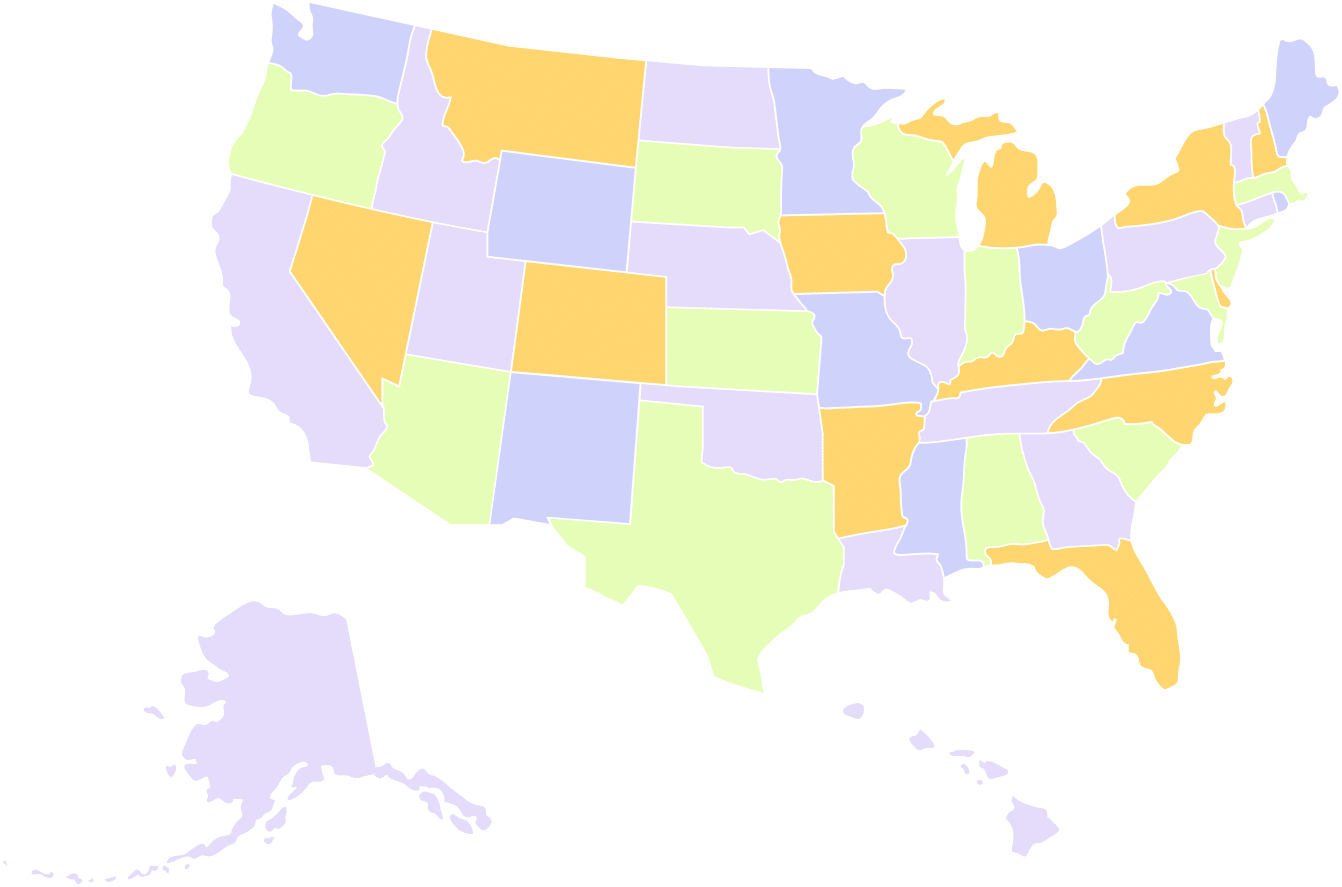

Students will be eligible for the Northeast Regional Prize if they are from one of the following states:

Students will be eligible for the Midwest Regional Prize if they are from one of the following states:

Students will be eligible for the South Regional Prize if they are from one of the following states:

Students will be eligible for the West Regional Prize if they are from one of the following states:

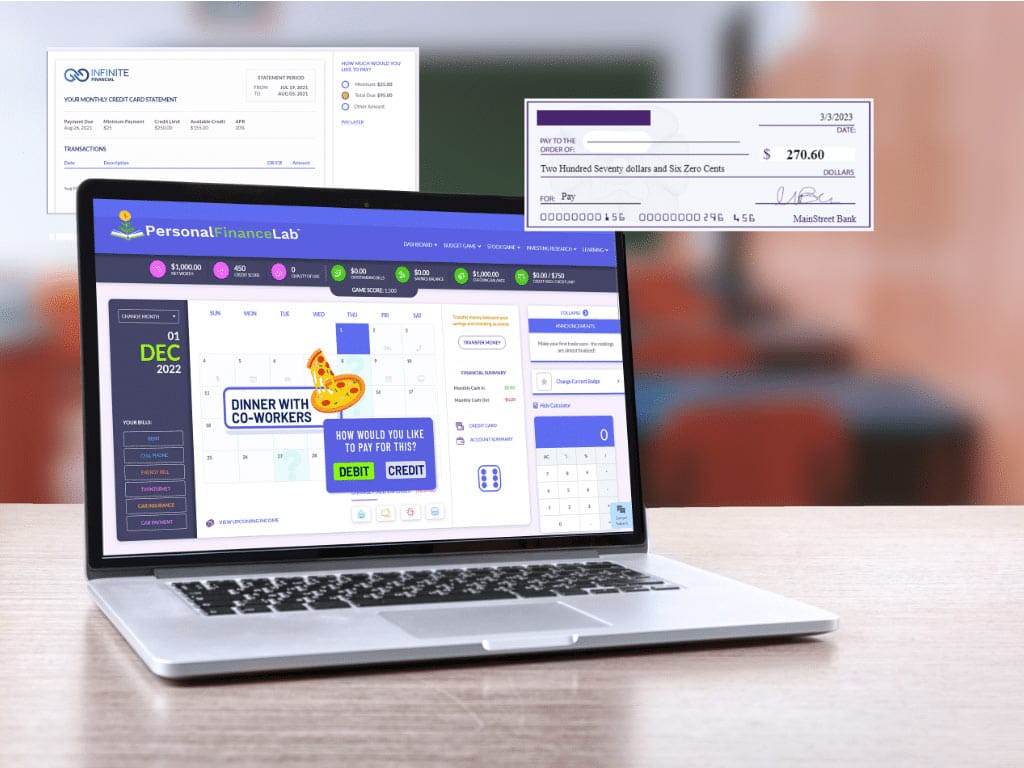

Students practice managing a monthly budget, and building their emergency savings fund while learning how to make responsible money management decisions.

Learn more

Students practice managing a virtual portfolio of US stocks, bonds and mutual funds. With live rankings, research tools, and real-time prices.

80+ self-graded personal finance lessons and financial literacy tutorial videos. Teachers can track student progress and grades.

Students taking part in the Financial Literacy Challenge also have access to over 80 supplemental lessons on personal finance topics.

These lessons are available from when a student is registered until the end of May. Completing all lessons is NOT a requirement to be eligible for prizes.

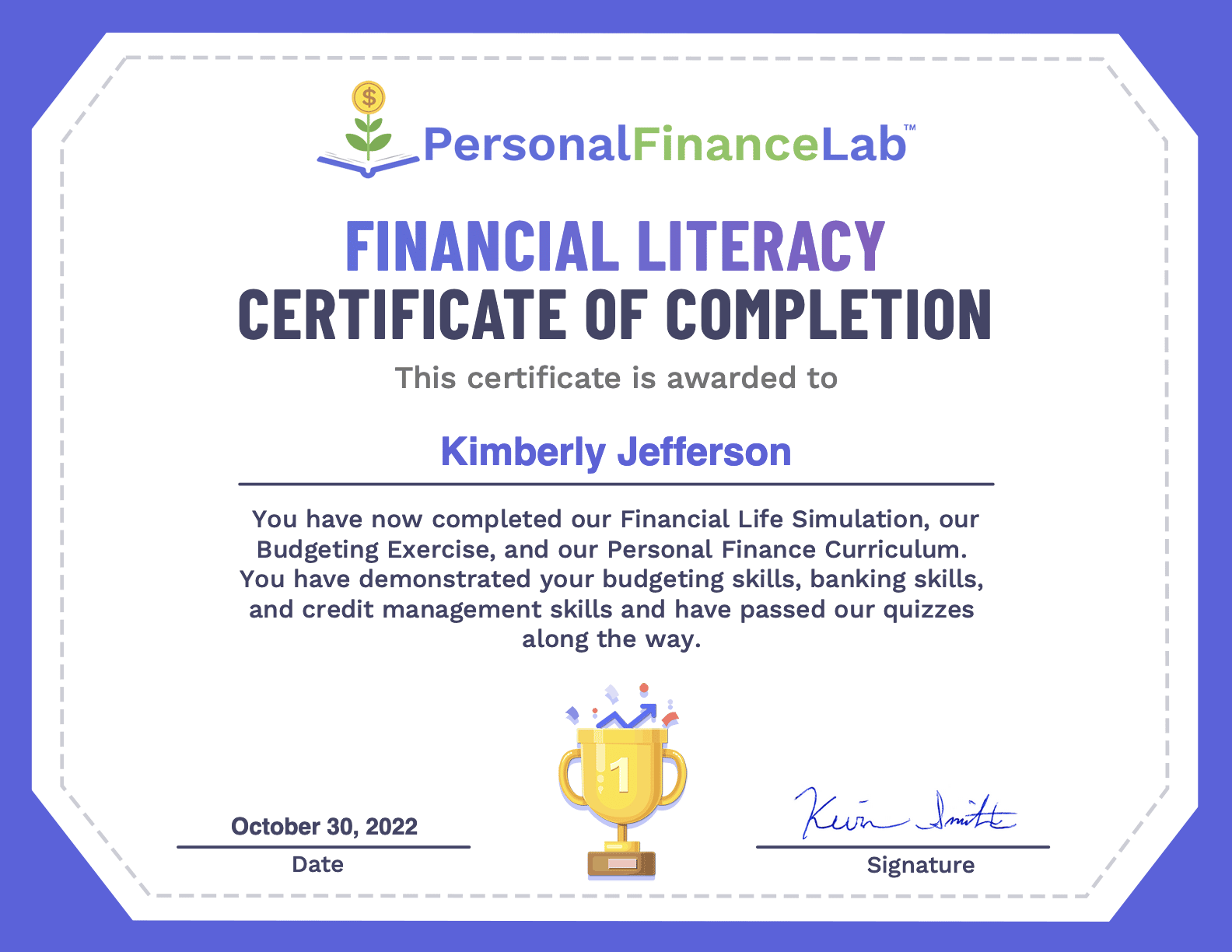

However, each student who completes all supplemental lessons by May 31, 2024 will earn the PersonalFinanceLab Certificate of Completion. Students can downloaded their certificate from their student dashboard as a PDF.

These lessons cover topics across: