Just in time for March, the Personal Finance Lab team is excited to announce a massive new update for our budgeting game!

Our latest update includes some huge enhancements for your class, including:

- An overhaul to the Quality of Life scores, making the point scoring system much easier to understand.

- A new Overall Game Score, synthesizing student’s Credit Scores, Quality of Life, and general savings habits into one metric.

- A new “Budget Builder” activity each month, where students compare their upcoming income, estimate their expenses, and set savings goals for the month.

- A new “Budget Summary” at the end of each month, showing students how well they stuck to their savings goals (and awards bonus points!)

- New integrated Tutorials and Lessons that occur regularly throughout the game highlighting key budgeting skills

Quality of Life Update

The key trade-off in our budgeting game (and real life) is the decision to Save or Spend. We capture this in our Quality of Life score, where students can increase their Quality of Life by renting nicer apartments, having better cell phone/internet plans, or buying luxury goods. Our original feedback was that many students were having a hard time understanding this score, so our new update makes things pretty simple:

They will get Quality of Life points for spending and purchases beyond the “Bare Minimum”, plus bonus points for Socializing, Studying, or taking care of their Household Chores.

Points From Spending

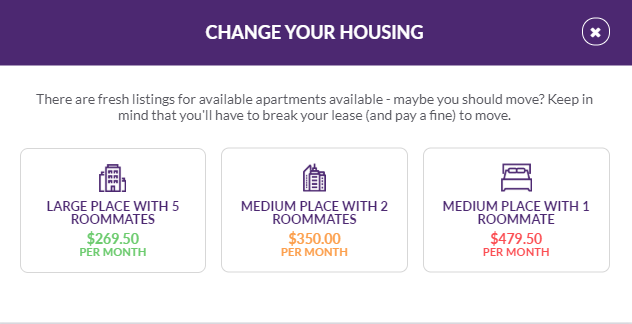

Every month, students make dozens of decisions in the game. But one of the biggest is where live. We give students 3 options when they first join:

In the example above, students who choose the $270 option would earn 0 Quality of Life points, since they are choosing the bare minimum to survive. Students choosing the middle option would earn 80 points each month (350 – 270 = 80), while students choosing the most luxurious option would earn 212 points.

Students have the option to move apartments or change their cell phone/TV plans any time (for a fee), so if they find they can’t quite afford the luxuries, they can scale down (and lose some Quality of Life). The same point system applies for all the other spending choices students face throughout the game – points are earned for luxuries above the bare minimum.

Points from Weekend Choices

Every weekend, students choose how to spend their time – Working to earn more money, Socializing with friends, taking care of Household chores, or Studying.

We now also award 50 Quality of Life points every time they Socialize, and 25 points every time they take care of their Household or Study.

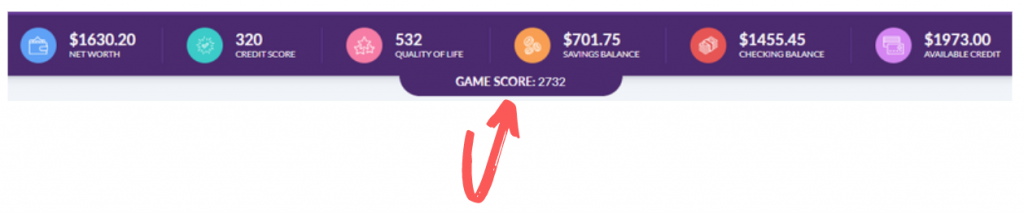

New Game Score

There’s a brand-new Game Score we added to the top of the Budget Game:

The Game Score is a metric on how well students are following Personal Finance best practices. Students maximize their Game Score by making wise personal finance decisions (not just trying to save every penny).

The new Game Score combines the student’s Quality of Life Score, Credit Score, and how well they are reaching their savings goals.

- Students earn 1 Game Score point for every Quality of Life point.

- Students earn 5 Game Score points for every Credit Score point.

- Students earn 1000 Game Score points by funding their Emergency Fund – 1000 points when they put $500 in their savings account, and another 1000 points when they save up a full $1000.

- Plus additional Game Score points for hitting monthly savings objectives.

We’ve balanced the Game Score to encourage students to build up their Emergency Fund quickly, always save at least 10% of their income, responsibly use their credit card, but also take care to invest in their Quality of Life (rather than simply always choose the cheapest options for every choice).

New Budget Builder

At the start of every month, students will now need to complete their Budget Builder – this will ask students to find their expected income for the month, estimate their expected expenses, and set a Savings Goal.

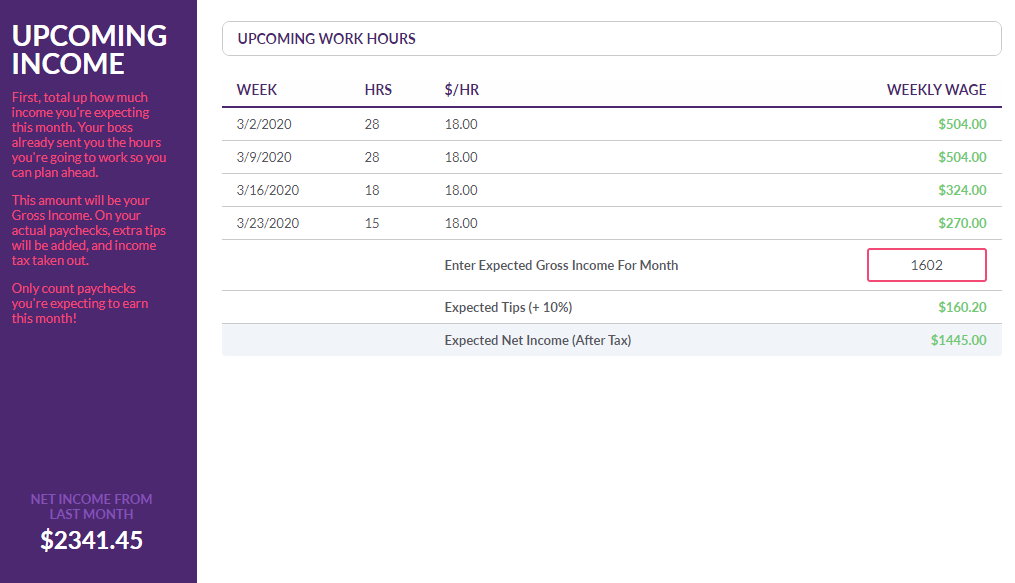

Estimating Income

First, students will see how many hours they are scheduled to work for this month. They need to sum up what they expect as their paychecks, and we give them an estimate for how many “Tips” they will receive, and deduct their income tax. We also show students how much they earned last month, so they can plan ahead if they expect to earn more or less.

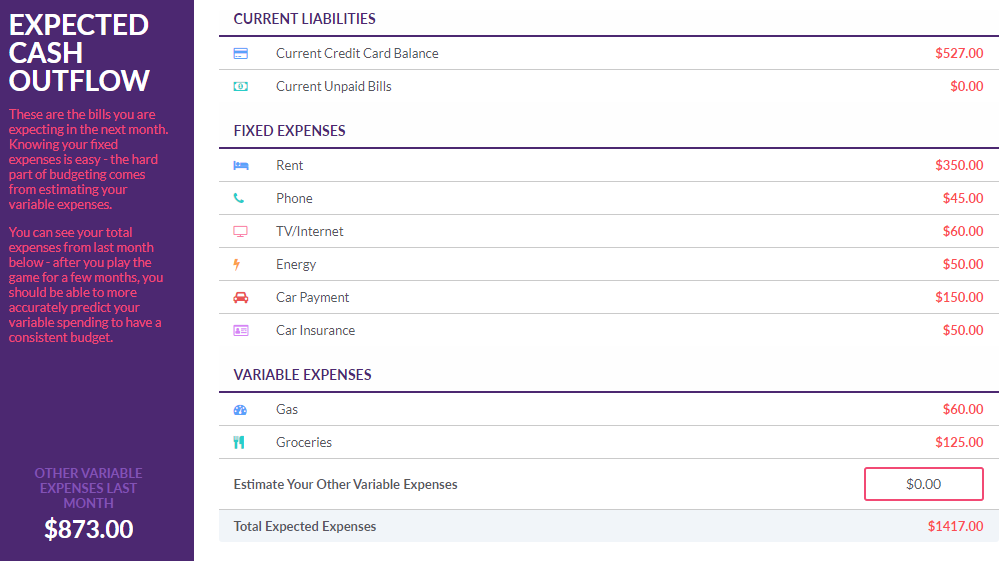

Estimating Expenses

Next, students see their expenses for the upcoming month – plus any unpaid bills and credit card balance they are carrying over from last month. Students need to make a guess as to how much they will spend in “Unexpected Expenses”. The first month of the game this will be a blind guess, but we also show students what they spent last month. This gives students a great way to learn how to estimate their expenses based on their spending history.

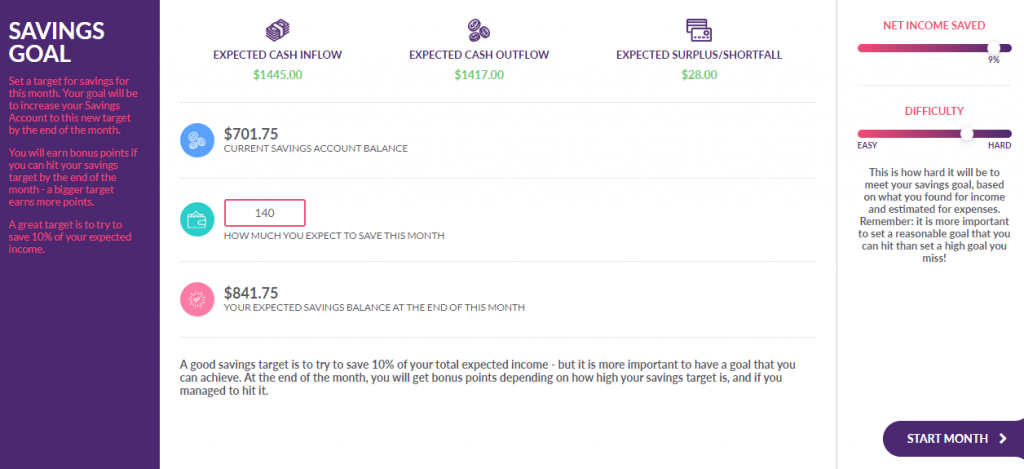

Setting Savings Goals

Last, we show students what they found their income and expenses, and ask them to set a Savings Goal for the month. We highly encourage to students to set a Savings Goal of 10% of their income, but it is more important to set a goal they can actually achieve than one they cannot. On the right side of the page, we give them a gauge on the quality of their goal (with 10% being “Great”), and a difficulty level (depending on their expected surplus or shortfall) – giving students a perfect benchmark to temper their spending for the month ahead.

End of the Month

At the end of each month, we also now prompt students with a Monthly Summary, showing how well they hit their savings goals.

- Students with a 10% or higher savings goal that hit it will earn an extra 600 Bonus Points to their Game Score.

- Students with a 5% or higher savings goal that hit it will earn an extra 300 Bonus Points to their Game Score

- Students with very low goals, or who miss their goals, don’t earn any bonus points.

Integrated Lessons and Tutorials

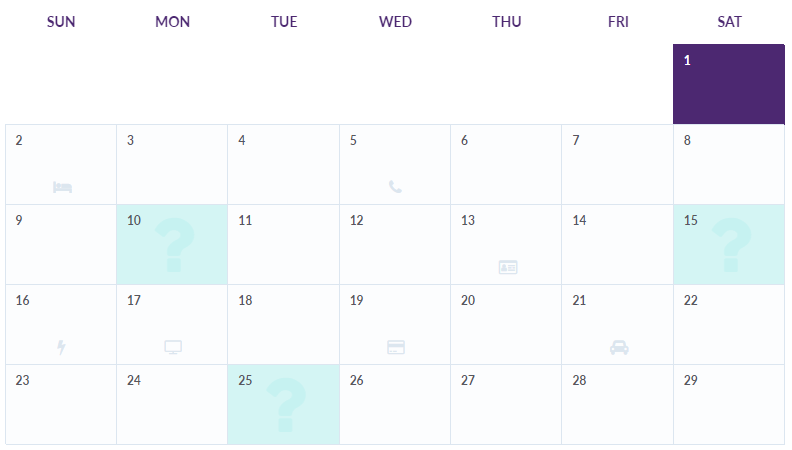

When students start the game, the calendar will look a bit different, with some new Green calendar days:

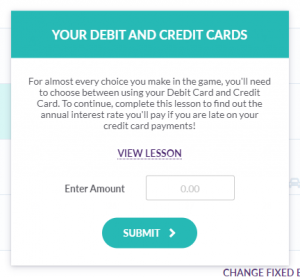

On these days students will be prompted with a mini-lesson both to illustrate an important Personal Finance concept, and to help them to be successful in the Budgeting Game.

Students need to read the short lesson and complete a Challenge Question to continue. Each mini-lesson takes between 2 and 5 minutes to complete.

Some of the first lessons include:

- The difference between their Debit Card and Credit Card

- The importance of an Emergency Fund

- How their Credit Card charges interest and fees

- How to prioritize their bills if they are short on cash

Students will get the most tutorials right at the start of the game, but a few more appear throughout the session (filing taxes, budgeting for the holidays, and other special events).

We hope your class gets as excited as we are to dive in and get budgeting!