The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but some fundamentals remain – buy what you know, do your homework, and don’t overthink your first steps!

A “Fraction” means one piece of a whole, a “Percentage” a calculation that will tell you how big one thing is in relation to another thing, and a “Ratio” is similar to a fraction but used to compare different things. Read this article for more details about these three terms, and how they apply to a portfolio.

In this article we will be looking at how you can use Excel to keep track of your account’s performance. This is meant as a basic guide for people who have little or no experience with Excel.

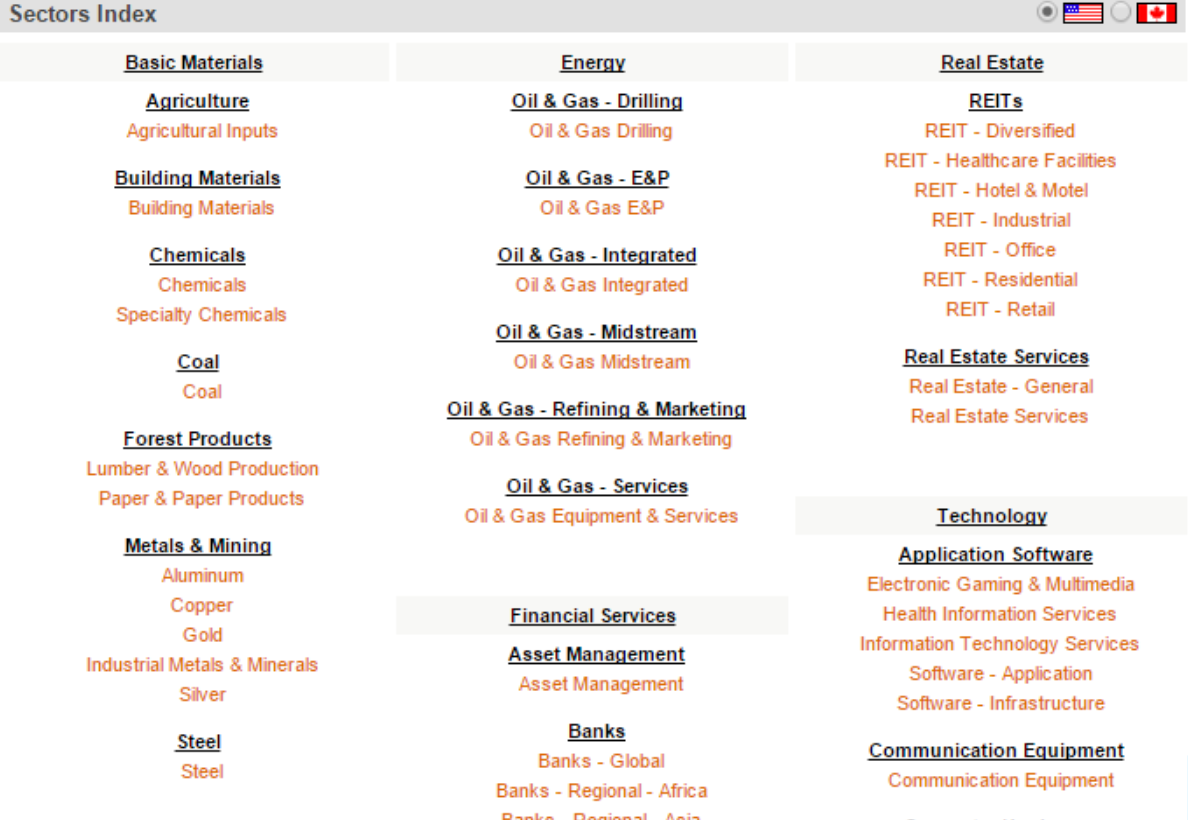

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between various sectors. Click on this post to find out how our Quotes Tool can help you diversify your portfolio.

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.”

A stock quote represents the last price at which a seller and a buyer of a stock agreed on a price to make the trade. Stock quotes also contain information about the volume, high and low prices of the day and year, and more.

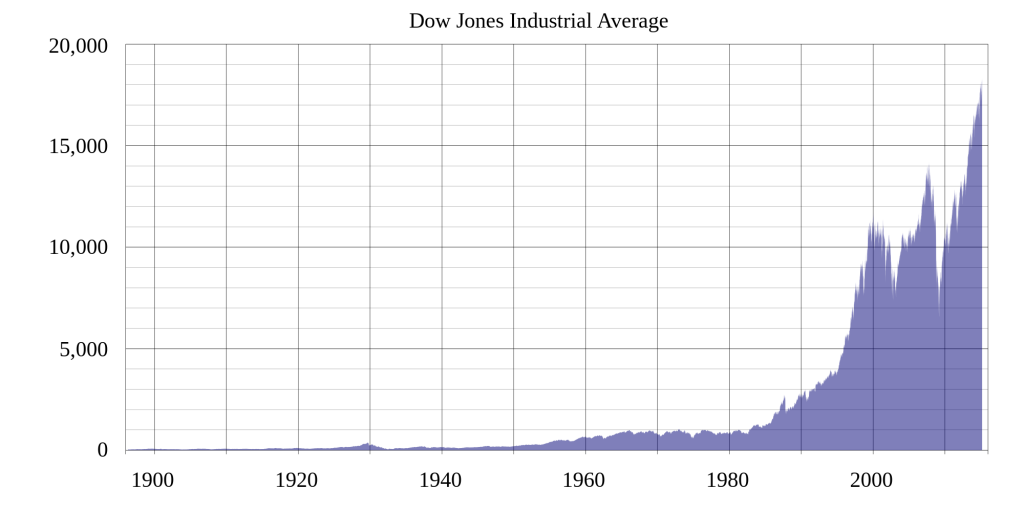

This simple answer is when you have money to invest for an extended period of time, the stock market historically has provided the greatest return. Read this post to understand why.

The New York Stock Exchange (or NYSE) is the largest stock exchange in the world, where buyers and sellers come to trade U.S. stocks!

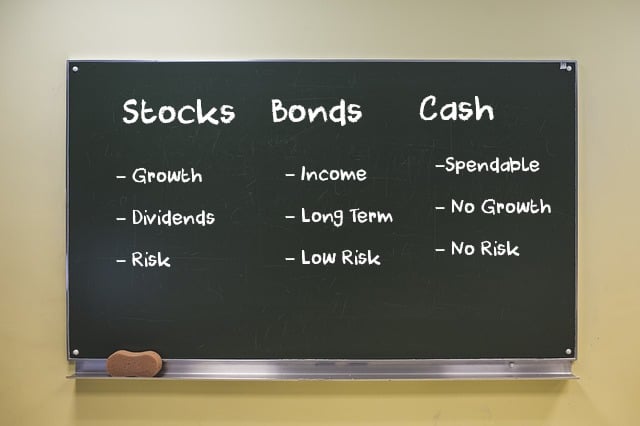

Stocks are a share of ownership of a company. If you own a stock, you are involved in some of its management decisions, and you are entitled to some of the company’s profits.

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running start. Click here for those techniques and strategies.

Mutual Funds come in several different “flavors”, but the core concept is always the same: the fund is a pool of money contributed from many different investors that are used to purchase a bundle of securities. They are professionally managed, so you are basically buying a piece of a larger portfolio.

“ETF” stands for “Exchange Traded Fund”, which is exactly how it sounds; they are like mutual funds in many ways, but they trade on a normal stock exchange like a stock, with their value being determined both by the value of the underlying assets and the value of the ETF itself.

The Dow Jones Industrial Average, more frequently know simply as the Dow or the Dow Jones, is a stock market index made up of 30 of the largest publicly-owned companies based in the United States. It is a price weighted index meaning that the index’s price is an average of the price of the 30 stocks that make it up. Though it is price weighted, this does not mean that every time there is split the index is completely changed, as they have factors to keep the value of the index consistent.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.

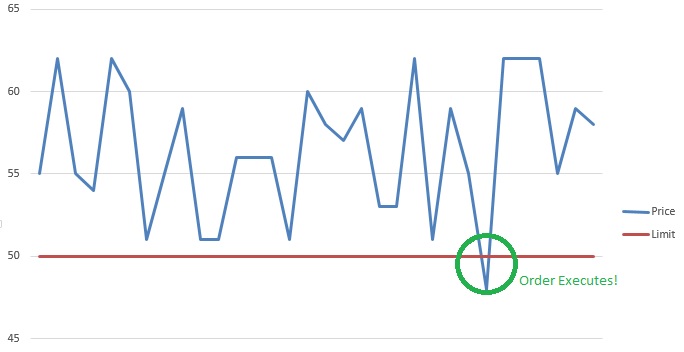

A Stop (or stop loss) order and Limit order are orders that try to execute when a certain price threshold is reached. These orders are mirrors of each other; they have the same mechanics, but have opposite triggers.

Your “Risk Level” is how much risk you are willing to accept to get a certain level of reward; riskier stocks are both the ones that can lose the most or gain the most over time.

An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs.

A “Good-Till-Day” order is simply one that will cancel at the end of the trading day if it does not fill.

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.” This article contains all the basics you need to know to diversify your portfolio!

There are also thousands of companies that want to sell shares to the general public, but are not able to sell on exchanges like NASDAQ, or the NYSE. Therefore, other exchanges exist to allow these companies to sell public shares. Stock traded on these “Over The Counter” exchanges are known as OTC stocks.

Serbia is a European country with an upper-middle income economy. It had one of the fastest growing economies of its region, in terms of GDP growth rates prior to the global recession, and attracted solid foreign direct investment. This article explores Serbia’s economic strengths along with the stock market, largest banks and ways one can invest in the country.

Latvia is an EU member country that experienced superior GDP growth rates prior to the financial crisis in 2008. It underwent significant privatization, which resulted in large foreign direct investment inflows. Its economy was ranked first among developing countries until 2008. Click here to read about the main Latvian industries, exchanges, and more!

Belgium is an EU member located in Western Europe. It has a strong industrialized economy, well-developed transportation infrastructure, and a highly productive work-force making it an attractive destination for foreign capital. Read this post for information on Belgium’s main industries and exchanges, as well as ways to invest in Belgian companies!

Italy is an EU member country and one of G-8 leading industrialized economies, having the seventh largest economy in the world. Its thriving small and medium enterprises play an important economic role.

Ireland is an EU member country with a knowledge-based economy and strong industries in services and technology. With attractive corporate tax rates, Ireland has been ideal destination for multinational corporations. Read this post for more information on Irish industries, exchanges, ways to invest in Ireland, and more!

Hungary is an EU member country with a medium-sized, liberal economy that is rapidly developing. It has the 5th largest economy in Central and Eastern Europe, with major exports in machinery, chemicals, textiles, and agricultural products. Read this article for more information about Hungarian industries, exchanges, and more!

Peru is a Latin American country with an emerging, market-oriented economy that has been among the top performers in South America. Rich in natural resources, it is a major exporter of gold, copper, zinc, and fish. Click on this article for more information about Peruvian industries, exchanges, and more!

Portugal is an EU member country with a high-income and service-based economy. It enjoys vast forests, has a strong industrial base, and is an important agricultural exporter. Read this article for information about Portuguese industries, exchanges, and more!

Romania is an EU member country, which has experienced positive foreign direct investment and GDP growth following privatisation initiatives over the last decade. It has an upper-middle income economy strong in its industrial and agricultural sectors. This article contains information about Romanian exchanges, and ways to invest in Romania.

Argentina is a South American country that is one of the G-20 economies. It is the third largest economy in Latin America and has the highest GDP per capita in its region. It possesses plenty of natural resources, a strong agricultural sector, and a well-educated population. Click on this post for information about Argentina’s main industries, main exchanges, and ways to invest in Argentina!

Albania is one of south eastern European countries that have shown promising economic growth potential. It has been increasingly attracting foreign direct investment and possesses a strong agriculture and natural resources industry. Read this post for more information about Albania’s main industries, stock exchanges, 10 most profitable countries, and more!

Once you have chosen your investment strategy it is time to start building your stock portfolio. Your strategies should be inline with your overall investment strategy such as whether you are day trading and the level of risk you are looking for. Click on this post for some strategies!

A portfolio is a collection of assets that contribute collectively to an overall return. There are many different reasons you could create a portfolio, and you need to define your reason or objective from the very beginning before adding stocks and other securities to your account. This will give a description of potential objectives a portfolio could have, as well as descriptions of potential assets you can choose.

A basic material used in manufacturing or commerce that is interchangeable with other the same commodities coming from a different source. The quality of a specific commodity may differ slightly, but it is essentially uniform across producers. When they are traded on an exchange, commodities must also meet specified minimum standards, also known as a basis grade. Typical types of commodities are corn, gold, silver, steel, etc.

The fee charged by a broker or investment advisor in exchange for investment advice and/or handling the purchase or sale of a security. Commissions vary from brokerage to brokerage.

The question of when to sell stocks is not easily answered, but this post ventures to give a description of how to know when it’s time to sell!

There is very little information available about how to handle the stocks you already own, but knowing Stock Exit Strategies is essential for minimizing your losses and protecting your portfolio. Read this article for information on Stock Exit Strategies.

The golden rule of stock investing dictates cutting your losses when they fall 10 percent from the price paid, but common wisdom just might be wrong. Instead, use some common sense to determine if it’s time to hold or fold.

The typical hedge fund is designed to be a partnership arrangement with the fund manager acting as the general partner responsible for making investment decisions, and is one of the investment tools serious investors aspire towards.

Buying what you know takes advantage of your familiarity with a product or market and translates that knowledge into potential earnings. Think of it this way; good investors understand opportunity and risk. Read this article to learn more!

Small cap stock investing is volatile. So, why risk your money by investing in what is typically considered risky business?

Market capitalization is calculated by multiplying the market price of stock by the number of issued shares of stock.

The buy and hold strategy is essentially just what it sounds like: Purchase stocks and then hold them for an extended period of time. The underlying assumption for the buy and hold strategy is that stocks tend to go up in price over extended periods of time.

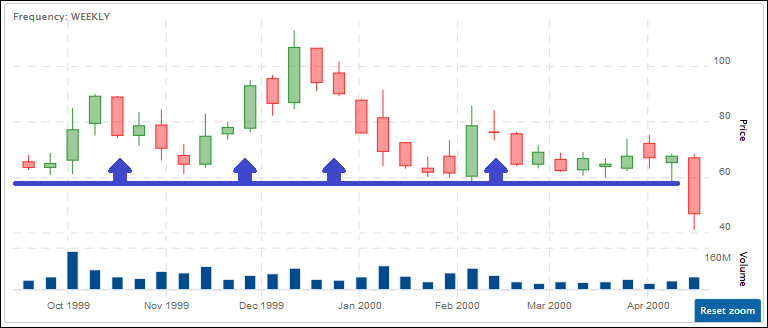

Learn the classic market cycles of accumulation, mark up, distribution and mark down so that you can time the market -consistently – and make steady profits any time.

The offer price, or the Bid price is what an investor is willing to pay for an investment. It is only an offer and will not be accepted if the seller is not willing to let go at the offer price.

The difference between the ask price and the sell price is called the “spread” and it is kept by the broker.

If you are brand new to investing then take time to understand what you are reading when viewing a Stock Exchange Symbol and learn Stock Market Investing Basics.

A national government that owes money to international financial institutions such as the World Bank, foreign governments, or to foreign lenders.

A corporation is an entity that abides by specific legal requirements that sets it apart as having a legal existence, as an entity separate and distinct from its stockholders (owners).