The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but some fundamentals remain – buy what you know, do your homework, and don’t overthink your first steps!

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.”

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running start. Click here for those techniques and strategies.

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.” This article contains all the basics you need to know to diversify your portfolio!

Once you have chosen your investment strategy it is time to start building your stock portfolio. Your strategies should be inline with your overall investment strategy such as whether you are day trading and the level of risk you are looking for. Click on this post for some strategies!

A portfolio is a collection of assets that contribute collectively to an overall return. There are many different reasons you could create a portfolio, and you need to define your reason or objective from the very beginning before adding stocks and other securities to your account. This will give a description of potential objectives a portfolio could have, as well as descriptions of potential assets you can choose.

The question of when to sell stocks is not easily answered, but this post ventures to give a description of how to know when it’s time to sell!

There is very little information available about how to handle the stocks you already own, but knowing Stock Exit Strategies is essential for minimizing your losses and protecting your portfolio. Read this article for information on Stock Exit Strategies.

The golden rule of stock investing dictates cutting your losses when they fall 10 percent from the price paid, but common wisdom just might be wrong. Instead, use some common sense to determine if it’s time to hold or fold.

Buying what you know takes advantage of your familiarity with a product or market and translates that knowledge into potential earnings. Think of it this way; good investors understand opportunity and risk. Read this article to learn more!

Small cap stock investing is volatile. So, why risk your money by investing in what is typically considered risky business?

The buy and hold strategy is essentially just what it sounds like: Purchase stocks and then hold them for an extended period of time. The underlying assumption for the buy and hold strategy is that stocks tend to go up in price over extended periods of time.

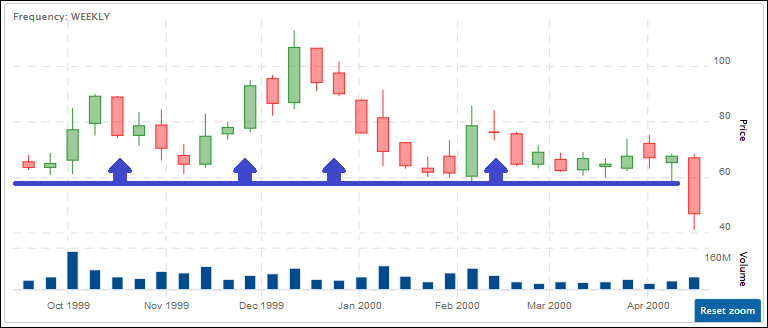

Learn the classic market cycles of accumulation, mark up, distribution and mark down so that you can time the market -consistently – and make steady profits any time.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more. Read this article for descriptions of a few of the main factors than affect stock market prices.

Day traders buy and sell the same stock (or other investment type) within a single trading day. Day trading has become a very popular way to make money, but it requires dedication and high volumes of cash.

The following strategies are used to trade ETFs.

A stock investing tactic where you purchase the ten DJIA stocks with the highest dividend yield at the start of each year. At the start of each consecutive year the stock portfolio must be adjusted so that it always holds the 10 highest yielding stocks.

The most basic research tool is the stock screener. Basically, screeners identify stocks that meet the user criteria. Read this article to learn more.

Read this article for steps to consider as you make your first trade!

Read this article for tips on how to select your trading strategy!

Traders, investment firms and fund managers use a trading strategy to help make wiser investment decisions and help eliminate the emotional aspect of trading.