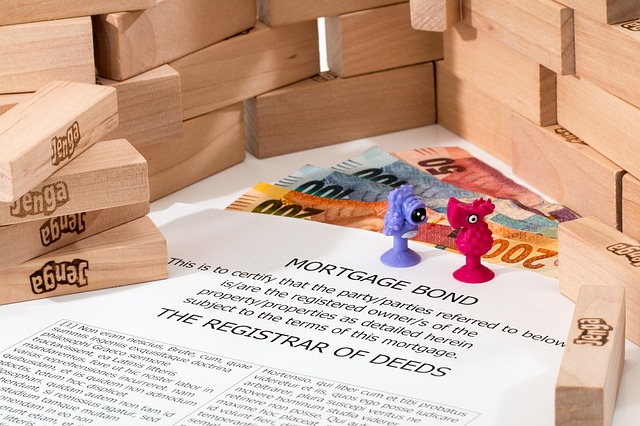

Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called a “Mortgage”, that breaks the principle and interest into equal payments over the entire term of the loan.

Building a budget or spending plan is tough. Sticking to the plan is even tougher. Remember to “Pay Yourself First”, and don’t lose your head – stick to the plan!

Bankruptcy is a type of forced debt settlement, and is a legal procedure. When you declare bankruptcy, the courts will gather all your unsecured creditors together, and hear the debts you owe. They will then examine all your assets, and pay out as much as they can to settle as many debts as possible.

Everyone has had financial emergencies – when a huge spending shock breaks your budget or spending plan into pieces. If you have more than one emergency in a short time, such as if you lost your job, your outstanding debt balances might start to spiral out of control. But, you can try to ease these troubles by calling your creditor to discuss debt negotiation.

Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest. Read this article for information about the differences between credit and debit cards, the types of credit balance, how finance charges and interest rates work with credit cards and gives details about the CARD Act of 2009.

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more – what do you want your portfolio to DO?

Building the next “Big Thing”. Being your own boss. Getting the full rewards for your work. There are a lot of reasons to start a business (along with lots of risks), but taking the plunge is a step every entrepreneur has to face if they plan on striking out on their own.

“Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of using credit.

As a young person, thinking about saving for retirement seems like a world away. However, being able to save enough for retirement means people have to start much earlier than they think.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.

The Cash Flow Statement is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). This statement presents where the cash and its equivalents are coming from and where they are being allocated.