A company’s financial statements give investors, managers, and other “users” a complete, honest look at its financial health. Finished financial statements follow a standardized format, letting investors compare different companies in the same industry apples-to-apples. These include Income Statements, Balance Sheets, and Cash Flow statements.

Brokerages exist to allow individuals to make investments into the larger market. In other words, they connect individuals to the markets as a whole

The core components of a case are a summary of the company’s background, analysis of their background, the company’s internal strengths and weaknesses, their opportunities and threats, the external environment the they compete in, an evaluation of your SWOT analysis, and some recommendations to remedy potential issues you find.

Do you ever wonder how companies have the money to build new stores, develop new products, or perhaps even buy another company? Usually companies do not keep enough cash for these transactions sitting in their bank account – it needs to be raised from outside investors. This process creates corporate debt.

Owning a share in a company means that you are an integral part of the puzzle that helps the company tick. Typically, investors choose to own a stock for one of two profit driven reasons: the dividends they will receive from the company, or the hope that the stock price will increase and they will be able to sell it for a higher price than they purchased it at.

Solvency is the possession of assets in excess of liabilities, or more simply put, the ability for one to pay their debts. People and organizations who are not “Solvent” face bankruptcy

Every business requires a solid risk management program that addresses property, liability, customers, employment, products, services, and everything else an organization. It should provide adequate internal control mechanisms, and a plan on what to do if something goes wrong.

Cash flow is a concept in accounting that refers to the spending or receiving of cash by an organization. For a given period, cash flow is calculated by ending cash balance less starting cash balance. It is important not to confuse cash flow with earnings, as cash flow is related to solvency, not profitability.

Stock and bond prices move up and down every day – sometimes by very large amounts. Movement comes primarily from supply and demand of shares – which in turn is largely driven by information and how investors perceive the companies in the markets.

Asset Valuation is the process by which an individual can assess the changes in a companies asset overtime. This is done largely through comparing ratios from a company’s financial statement, but can also be a more complex affair (depending on what is being valued)

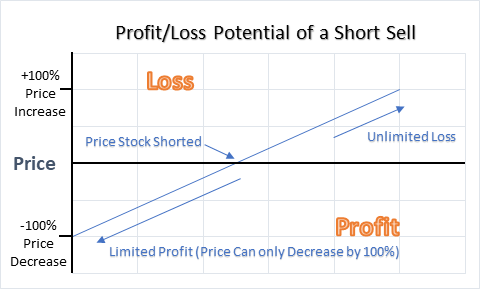

Margin trading is when you borrow money to invest. This increases the risk because now your returns need to not just make a profit, but more of a profit than you pay in interest. Market timing is also risky – instead of relying on fundamental business data, it means trying to pick the perfect hour, minute, or second to “beat” other traders who are trying to do the same thing.

Risk Management is when a manager tries to organize his company (or business unit) to prepare in case of, and try to prevent, something going wrong. Risk management is one of the most important parts of management and internal controls

Have you ever thought about a career in the finance industry? Have you wondered what is required to be considered a professional in the stock trading world? You’ll need to know about the SIE exam, Series 7, Series 63, CFA, CPA, CFP, and more!