Today, all of our financial lives are online. This creates a problem when making sure that you are the only one who has access to it. Fraud and Identity Theft are growing problems, impacting just about everyone, but there are some steps you can take to avoid this.

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more – what do you want your portfolio to DO?

Building the next “Big Thing”. Being your own boss. Getting the full rewards for your work. There are a lot of reasons to start a business (along with lots of risks), but taking the plunge is a step every entrepreneur has to face if they plan on striking out on their own.

“Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of using credit.

Credit reports are documents that keeps a record of (most) of your regular bill payments. They are not to be confused with credit scores, which is are single number. Having good credit reports are vital to demonstrating your financial stability, which is important for activities like applying for a mortgage.

Consumers, aka every individual who participates in the economy, have a rights and responsibilities. Depending on your state and the transaction, you might have a wide range of rights or very few. Believe it or not, with the rise of social media, your most important right might be the “right to complain”!

As a young person, thinking about saving for retirement seems like a world away. However, being able to save enough for retirement means people have to start much earlier than they think.

“Labor” is how much a person works. It is the use of time an exertion of effort to produce something of value. Generally speaking, the more valuable a person’s labor is, the higher their wage.

“Unemployment” is a major economic indicator measuring how much of the working population is currently looking for a job. Just because someone is jobless doesn’t mean they are unemployed – they need to be looking for work!

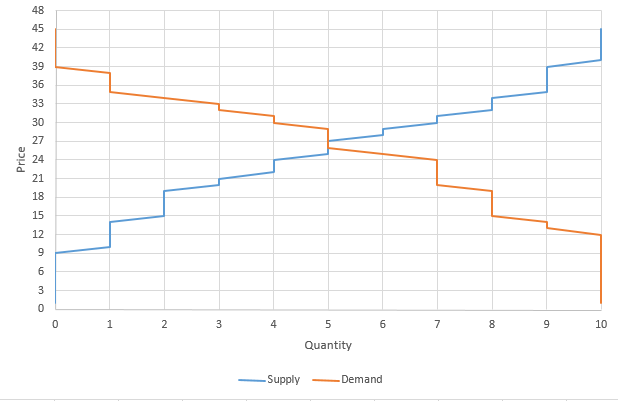

“Price Controls” are artificial limits that are put on prices. If the limit is put in place to prevent prices from getting too high, they are called Ceilings. If they are in place to prevent the price from getting too low, they are called “Floors”.

Interest rates are a percentage that is used to calculate how much a loan or investment grows over time. A “Nominal” interest rate is just the percentage on the loan – the “Real” rate subtracts expected inflation

Scarcity refers to the fact that resources are finite – people and organizations need to allocate their finite resources between their infinite wants.

“Specialization” is when a labor force begins to divide total production, leading to a rise of experts or specialists. This is called the Division of Labor, and it typically results in much higher productivity of labor.

“Opportunity Cost” is what needs to be given up to get something. This is different from an item’s price – it refers to what you give up in order to get something. The opportunity cost for going to school is that you can’t stay home and nap. The opportunity cost of staying home to nap is not getting your diploma!

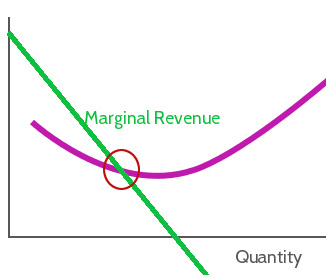

Everyone knows about costs and benefits of doing something – the pros and cons of making a choice. Marginal benefit and marginal cost are different – they look more closely at doing slightly more or less of different alternatives. Marginal costs and benefits are extremely important to producers when choosing their inputs and prices.

Competition occurs in market-based economies, and can be beneficial since it generally leads to lower prices, more choice, and better qualities of products for consumers than other types of economies.

This article describes the Business Cycle, which is the broad, over-stretching cycle of expansion and recession in an economy.

An Entrepreneur is someone who takes a risk to start a new business. Nearly every business that exists (apart those created as spin-offs of other businesses, or by government intervention) was started by one or several entrepreneurs, who took a risk to launch a new company.

Economic Incentives include anything that pushes people, businesses, and governments to do one thing or another. These include what products you buy, what career you choose, what products businesses produce, and what government programs are put in place

In Economics, an “Externality” is a benefit or cost that is not reflected in the price of a good or service. They can be positive or negative.

Economic Growth means that economy is growing – more goods and services are being produced and consumed than they were before. The most common measurement of economic growth is the Gross Domestic Product (or GDP), which measures the total number of finished goods and services produced in an economy in a year.

A “Contract” is a legally binding agreement between two parties (people, companies, or both). Having a contract means that if one party does not keep their word, the other can sue them in court to either force them to fulfill their side of the agreement, or pay back compensation.

Economics studies the trade-offs from a variety of choices. Individuals make these choices everyday, in order to best improve their outcome.

Companies come is all shapes and sizes, with differing levels of liability for its owners. Different types of companies also have different levels of “Liability” – how “on the hook” the owners are for business debt

Knowing your net worth is the first step towards growing it! Click on this post for a tool that will help you organize your assets in one place, and even help project how they will grow in the future.

When someone talks about banking, they generally group together Banks, Credit Unions, and Savings and Loans all in one – but their differences can have a big impact on the services you get!

A Spending Plan is a plan of what you will spend each month, and includes fixed and variable spending. They are used similarly to a budget, but many find them to be more flexible

Money has value because we all agree it has value, and so we can use it as a medium of exchange. Forms of Stored Value simply are a storage system for money like checks and debt cards, meaning they do not have any value in and of themselves.

“Wealth” means having an abundance of something desirable. This can be tangible, like money and property, or intangible.

Financial Records are what you use to have an easy way to tell where all your money and assets are, and exactly how much you have, at any given time. Most people’s financial records will not look the same as anyone else’s, because each person has unique ways of organizing their information to make it most accessible for him- or herself.

“Major Economic Indicators” are numbers that you can look at to try to get a picture of how well the economy is doing. This includes GDP, Output, Inflation, Unemployment, and more!

The stock market is the perfect place to see Supply and Demand in action! Many buyers and many sellers meet to trade – with the “market equilibrium” moving in real-time based on new information

There are many different economic systems that try to result in more equality or faster growth. The structure of a country’s economy has a lot to do with the country’s politics and the values of its population. However, the economy of every country also changes over time, and how it falls between these broad categories will often change with it.

The Federal Reserve Bank, or the “Fed”, is the central banking system of the United States. It serves as the primary regulator of the US dollar, as well as the “lender of last resort” for other banks.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. H

This tool will also help you see exactly how much you can set aside for savings every month!

This calculator will help show the impact of many of the biggest factors people need to consider when taking out their first loan for a big purchase!

Use this Credit Card Payment Calculator to see how easily and quickly credit card debt builds!

Click on this post for an Investment Return and Compounding Interest calculator to test out how compound interest can effect your personal finances!

The Advanced Investment Return Calculator can help you find the difference between simple and compound interest or see how big an impact your tax rates and inflation have on your savings over time!

Click on this post to learn a simply trick on how to save to become a millionaire!

Use the calculator to see if buying or leasing a home is better for you!

Use this calculator to find Net Present Value, based off expected annual growth, cash flow over a variable number of years, and separations of cash flow between investments and operations.

Use this calculator to calculate an Internal Rate of Return!

Gross National Product (GNP) is the value of all goods and services produced by a country’s residents.

Financial modeling is the creation of a program or structure designed to incorporate a company’s financial information and projections, and subsequently come up with a valuation used for investment decision making. Read this article to learn about its uses and the key elements in financial modeling.

Covariance is a statistical measure of the extent that 2 variables move together relative to their respective mean (or average) values.

Correlation is a measure of the strength of linear association between two variables or more variables of interest. We can measure the degree and direction of their linear association using correlation analysis. Read this article to learn more!