The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but some fundamentals remain – buy what you know, do your homework, and don’t overthink your first steps!

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.”

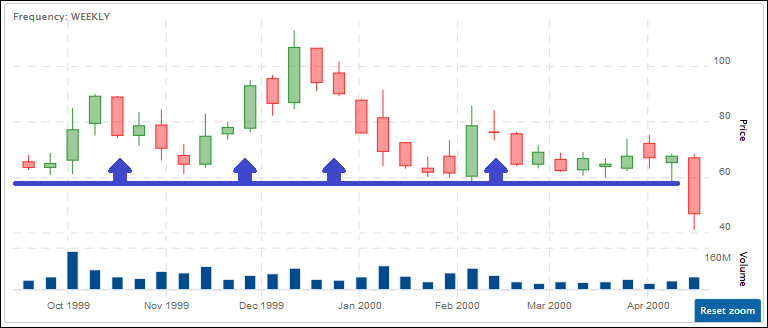

A stock quote represents the last price at which a seller and a buyer of a stock agreed on a price to make the trade. Stock quotes also contain information about the volume, high and low prices of the day and year, and more.

A “Ticker Symbol” is a unique one to five letter code used by the stock exchanges to identify a company.

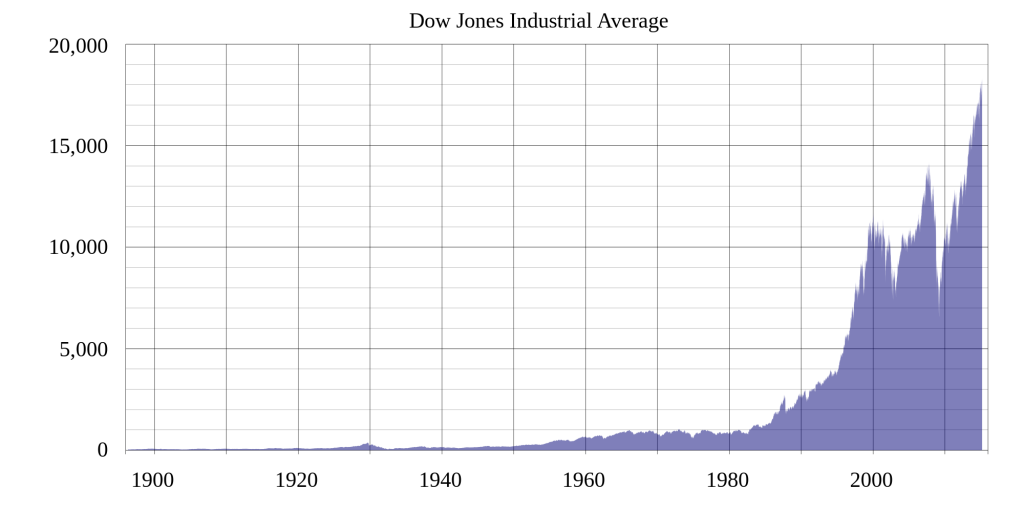

This simple answer is when you have money to invest for an extended period of time, the stock market historically has provided the greatest return. Read this post to understand why.

“Wall Street” is a street in New York City, near the southern end of Manhattan Island. It is the home of the New York Stock Exchange, and the biggest center of stock trading and finance in the world.

The New York Stock Exchange (or NYSE) is the largest stock exchange in the world, where buyers and sellers come to trade U.S. stocks!

Stocks are a share of ownership of a company. If you own a stock, you are involved in some of its management decisions, and you are entitled to some of the company’s profits.

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running start. Click here for those techniques and strategies.

Mutual Funds come in several different “flavors”, but the core concept is always the same: the fund is a pool of money contributed from many different investors that are used to purchase a bundle of securities. They are professionally managed, so you are basically buying a piece of a larger portfolio.

“ETF” stands for “Exchange Traded Fund”, which is exactly how it sounds; they are like mutual funds in many ways, but they trade on a normal stock exchange like a stock, with their value being determined both by the value of the underlying assets and the value of the ETF itself.

The Dow Jones Industrial Average, more frequently know simply as the Dow or the Dow Jones, is a stock market index made up of 30 of the largest publicly-owned companies based in the United States. It is a price weighted index meaning that the index’s price is an average of the price of the 30 stocks that make it up. Though it is price weighted, this does not mean that every time there is split the index is completely changed, as they have factors to keep the value of the index consistent.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.