A covered put is an options insurance strategy where you simultaneously have a short open position on a stock and sell a put option for the same underlying option. Adding a short put in your open positions means that you are obligated to buy your stocks at the strike price, contingent on the option buyer’s actions. However, you already have the short stock in your open position, which means you will gain the difference from the short stock and the short put. The combination of those two products creates a payoff that is like a short call. However, the profit is not the same since you spent more on a covered put versus a short call.

What are its components?

The covered put has two components:

- Short Stock

- Short Put

When and why should I have a covered put?

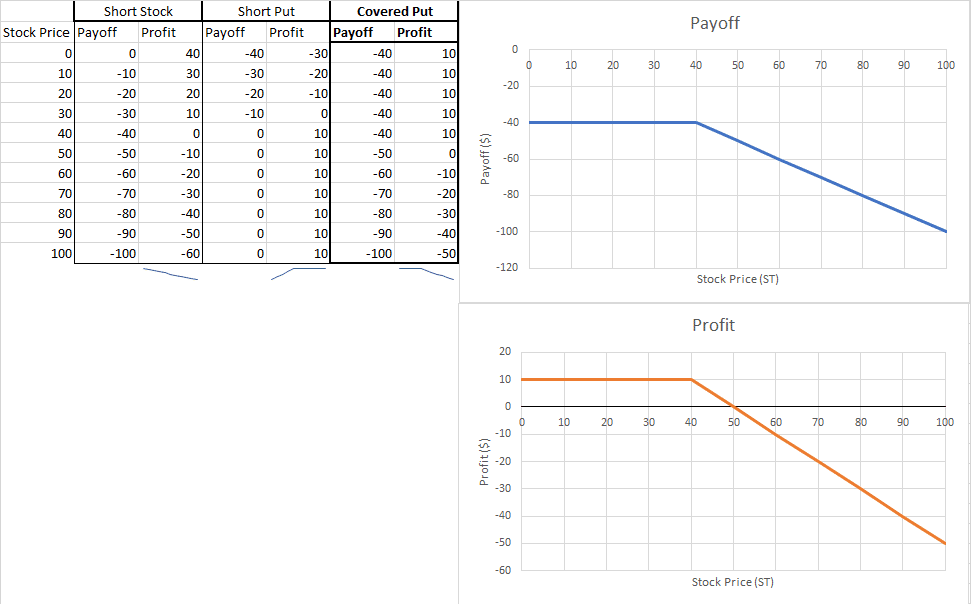

You should have a covered put if you are moderately bearish on a security and wish to have an extra protection in case the price of the stock goes up. By adding a short put to your short position, you are willing to forego the additional profit should the stock drop for protection if the stock increase in price. The effect of adding a short put to your short position can be seen in the profit tables below.

What is the payoff and profit graph?

What is the break-even point?

The break-even point of a covered put can be defined by finding the stock price where the covered put generates a zero-dollar profit. By adding the short stock and the short put together and equating it to zero, you should solve for ST.