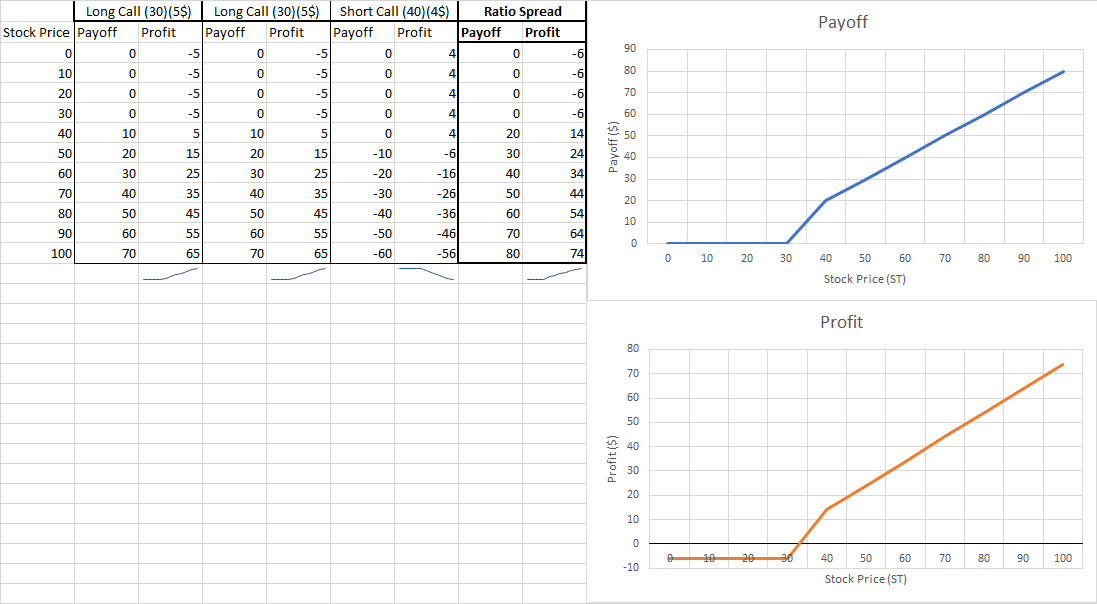

A ratio is an option strategy that is created by having X amount of call options at Strike Price 1 and shorting Y amount of call options at Strike Price 2. By creating a ratio, you are creating an option strategy where you can reduce your total option costs by shorting more call options are a higher strike price.

What are its components?

A ratio strategy has four components:

- X amount of long call options

- Y amount of short call options

When and why should I have a ratio strategy?

You should have a ratio strategy if you have a bullish view on the performance of the underlying asset. By shorting Y amount of call options, you are consistently reducing your option costs and eventually creating a zero-cost strategy. The ratio can be adjusted based on the investor’s perception of asset. The same concept can be applied with puts.

What is the payoff and profit graph?

What is the break-even point?

The break-even point of a ratio strategy can be defined by finding the stock price where the bear spread generates a zero-dollar profit. By adding all contracts and equating it to zero, you should solve for ST. There is a possibility where two stock prices can break-even. To find both points, you should create scenarios to define the payoffs. For example, the payoff when ST<30, 30<ST<40, 40<ST.