What are the objectives of financial statements? How can accountants best meet these objectives? These are the very questions that the Federal Accounting Standards Board (FASB) set out to address in 1976 when they began developing the conceptual framework. FASB’s goal was to identify the objectives and concepts that govern the preparation and presentation of financial reporting. In other words, to provide a backbone for the financial accounting system. The conceptual framework creates consistency for the standard setters, preparers, managers, auditors, and other users of financial statements in their jobs. These different groups use the conceptual framework to set rules, follow rules, ensure those rules are being followed, and make decisions with confidence.

The objective of financial reporting

The purpose of financial reporting is to provide users with information about a company.

The purpose of financial reporting is to provide users with information about a company.

The users are existing and potential investors, lenders, and creditors. Financial reports help users make decisions about providing resources, usually cash, to a company. Investors are seeking to buy equity (or ownership of the company), which will allow them to share in the company’s profits. Lenders are seeking to loan money to the company which will be paid back along with interest. This is important because companies need cash to support their growth and users need to be able to see that their cash will, in fact, help support that growth. Financial reporting should focus on the needs of the most important users – those that seek to provide resources to a company to earn interest or make a profit.

Fundamental Qualitative Characteristics

What information should be measured, reported, disclosed, and how should that information be presented in the financial reports?

The conceptual framework covers qualitative characteristics of accounting information that differentiates between more important and less important information.

Financial information is useful when it is both relevant and represented faithfully. By identifying and expanding on these characteristics, classifying information as important or less important becomes more objective for everyone, and different financial reports can be compared directly.

Relevance

For information to be relevant, it must be able to influence a decision. There are three ingredients of relevant information: predictive value, confirmatory value, and materiality.

Predictive Value

Predictive value is relevant because it helps users forecast and set their own expectations for the future.

Predictive value is relevant because it helps users forecast and set their own expectations for the future.

Confirmatory Value

Confirmatory value is relevant because it provides feedback that allows users to confirm or correct their prior expectations.

Materiality

Materiality is relevant because it includes information that can make a difference in the users’ decision.

Faithful Representation

For information to be of faithful representation, the reported information must match what existed or actually happened. There are three ingredients of faithful representation: completeness, neutrality, and free from error.

Completeness

Completeness means that all necessary information is provided and none of it is omitted.

Neutrality

Neutrality means that the company must present information as is; results can NOT be manipulated to look better or worse than they actually are.

Free from Error

Free from error means that the information is accurate and correct.

Elements

All financial reports are made up of some of the same basic elements, regardless of the type of company being reported.

Assets

Assets are resources resulting from past events or transactions in which future economic benefits are expected. Assets may be short-term (cash, accounts receivable, pre-paid assets) or long-term (building, land, office equipment), but either way, they will benefit the company in the future.

Assets are resources resulting from past events or transactions in which future economic benefits are expected. Assets may be short-term (cash, accounts receivable, pre-paid assets) or long-term (building, land, office equipment), but either way, they will benefit the company in the future.

Liabilities

Liabilities result from a past event that created an obligation. An obligation typically means the company must transfer assets (often cash) or provide a service to settle the liability. Liabilities also may be short-term (due in less than 12 months) or long-term (due in more than 12 months).

Equity

Equity is how much the company is worth to its shareholders, and this is calculated by subtracting the company’s liability from its assets. This means if you own a company that has $100,000 in assets and $70,000 in liabilities, then your equity must be $30,000. If you were to sell your assets and settle your debt, you would be left with your equity of $30,000.

Revenues

Revenues are inflows of assets from when a company sells goods or services that continue their main operations. For instance, McDonald’s source of revenue comes from selling hamburgers. Revenues result from what a company does to “make a living.”

Expenses

Expenses are outflows generated by using assets, increasing liabilities, or both. Simply put, expenses are the cost of doing business (you got to spend money to make money!).

Gains

Gains increase a company’s equity, but unlike revenue, gains are incidental. For example, let’s say McDonald’s spends $200,000 to purchase land to build a new restaurant on. However, one year later, the company decides not to build on this lot and sells it for $220,000. This gives McDonald’s a $20,000 gain on sale. This sale is considered incidental because McDonald’s is in the business of selling hamburgers, not land. In this instance, equity increases, but revenue does not.

Losses

Losses reduce a company’s equity, and like gains, losses result from an incidental transaction. Therefore, if McDonald’s purchases land for $200,000 and sells that land for $180,000 one year later, the result will be a $20,000 loss to the company. This is because McDonald’s is in the hamburger business, not the real estate business.

Assumptions

There are also some assumptions made when preparing financial reports, each of which are vital when trying to compare different companies.

Economic Entity

Economic entity assumes that the company is its own separate entity. In other words, a business owner is a separate entity from his company.

Going Concern

Going concern assumes that the company will go on forever unless there is information contrary to this assumption. This is important because we record long-term assets at cost and depreciate them over their useful life. In doing so, we must assume that the company will be around long enough to actually do this, and does not plan on simply selling off assets after a certain amount of time.

Monetary Unit

Monetary unit assumes that money is the constant in accounting; everything in the financial statements must be expressed in dollars or “monetary terms.” If an economic activity cannot be expressed in dollars, it is not recorded. Additionally, this assumes that the U.S. dollar is stable, therefore, no adjustments need be made for inflation.

Monetary unit assumes that money is the constant in accounting; everything in the financial statements must be expressed in dollars or “monetary terms.” If an economic activity cannot be expressed in dollars, it is not recorded. Additionally, this assumes that the U.S. dollar is stable, therefore, no adjustments need be made for inflation.

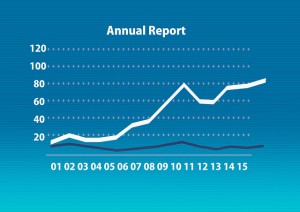

Periodicity

Periodicity assumes that the company can divide ongoing activities into specific time periods. Typically, companies will report its results monthly, quarterly, and annually. This allows users compare results from one period to the next.

Principles

There are also some core principles in making these measurements, which involve how you can assume values change over time. Any changes in these core principles between companies would make it completely impossible to directly compare their financial statements.

Measurement Principle

Measurement principle commonly includes historical cost and fair value.

Historical Cost

Historical cost reports assets and liabilities based on what it cost to purchase it, otherwise known as the acquisition cost. For instance, if you purchase land for $200,000, ten years later, you will still report that land at $200,000.

Fair Value

Fair value measures assets and liabilities by what they are currently worth. This means if you purchase land for $200,000, but ten years later could sell it for $220,000, you will report that land for $220,000. Think of historical cost as ‘what did you pay?’ and fair value as ‘what is it worth?’ when measuring assets and liabilities.

Revenue Recognition

Revenue recognition principle details how a company records its revenue. Under this principal, revenues are recorded in the period that they are earned and not necessarily when cash is received. This is important to understand when customers pay you on credit. Even though you don’t have cash-in-hand, you still earned the revenue, and therefore need to record it on that day (not the day you receive payment!).

Revenue recognition principle details how a company records its revenue. Under this principal, revenues are recorded in the period that they are earned and not necessarily when cash is received. This is important to understand when customers pay you on credit. Even though you don’t have cash-in-hand, you still earned the revenue, and therefore need to record it on that day (not the day you receive payment!).

Matching Principle

Just like revenue recognition, the matching principle tells us to record expenses when they are incurred and not necessarily when cash is paid. If you purchase supplies, for example, on credit, you still incurred an expense, and therefore need to record it on that day.

Full Disclosure

Full disclosure principle states that any information that would affect a users’ understanding of the financial statement should be included. However, this information could go on forever, and so accountants need to draw the line somewhere. This means you only include information that is likely to have a material impact on the company. As we noted above, a material impact indicates that the information could make a difference in the user’s decision.

Accrual-basis vs. Cash-basis Accounting

Companies need to follow strong revenue recognition, but how can they tell exactly when revenue was “earned”? This is the central question addressed by choosing between accrual- or cash-basis accounting.

Accrual-Basis

Accrual-basis accounting records revenue on the income statement when the work is completed and records expenses when they are incurred.

Cash-Basis

Cash-basis records revenue on the income statement only when cash is received and records expenses only when cash is paid. For example, if your neighbor pays you $20 on Friday to walk their dog on Saturday and Sunday, you would likely consider yourself $20 richer on Friday.

This assumption is correct on a cash-basis because you received the money on Friday. However, on an accrual-basis, you have not earned any money until the dog has been successfully walked on Sunday. You can consider yourself $20 richer only after you have completed your obligation to your neighbor.

Pop Quiz

[qsm quiz=92]