Short Put

Recall that a put option is a contract where the buyer has the right (not the obligation) to exercise a sell transaction at a specific strike price before an expiration date. A short put is a term used when you sell a put option for an underlying asset.

A trader that has a short put option is also referred as a trader that wrote a put option. This means that the trader wrote this option contract with a belief that the buyer of the contract will not exercise it. If this happens, the writer will pocket the profits from selling the contract. If the buyer of the put option does exercise his rights, the writer must buy from him/her the shares, with respect to the specifications of the contract. In other words, an put option writer has an obligation to buy shares of the underlying contingent on the option buyer’s actions.

In the world of trading, a short position on a put option (“sell to open”) means that you sold a contract that gives the buyer of that contract the right to sell the underlying asset at a specific price, before a maturity date. If the buyer decides to exercise his right, you are obligated to purchase from him the shares with respect to the requirements that you have both agreed upon. It is important to note that the seller of a put option has no exercising rights. Thus, the only way to close this option contract would be to “buy to close” or cover the contract in question.

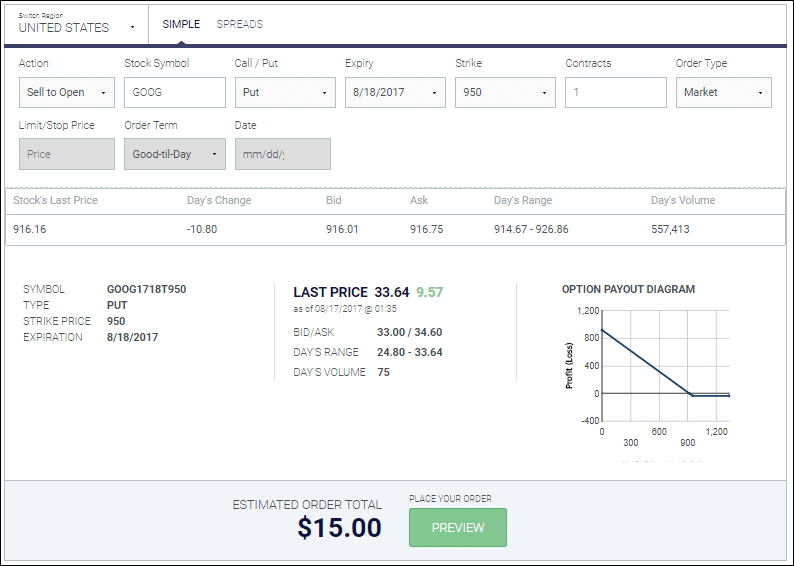

What are its components? Can you show me how to short sell a put option?

The components of a short put are quite simple. You simply need to perform an order to sell to open an option contract based on your desired specifications:

When and why should I have a short put?

You should short a put option if you expect the stock price to remain above the strike price. In a situation where the stock’s price is above the strike price, you will be able to pocket the premium, since the buyer did not exercise his right. Evidently, writing a naked put can be very risky should the price drop below the strike price. Traders write options to implement it to certain strategies that will be discussed later.

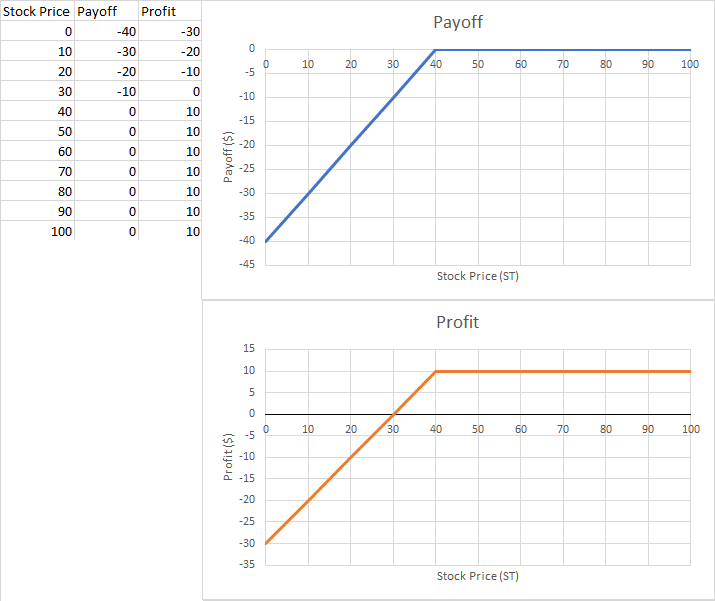

What does it look like graphically? What is the payoff and profit graph?

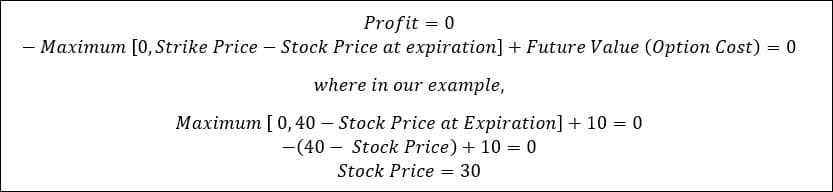

What is the break-even point?