What is a Cash Flow Statement?

Businesses keep financial records so they will know how their company is performing financially. For publicly traded companies (ones you can purchase stock in), these records are also shared with investors. The three main financial statements companies use are the Income Statement, the Balance Sheet, and the Cash Flow Statement.

Every time you get a paycheck, you think about the bills you have recently paid and the upcoming ones that require payment soon. You know which bills need to be paid regularly, how much money that will take, and you are aware that extra money is needed at different times, for things such as car repairs and medical expenses. The cash flow statement does something similar – it allows company management to see where the company’s money is coming from and how it is being spent. Most companies will complete a cash flow statement at least quarterly because it the best financial report to show how well the company generates cash to pay its debts and fund its operating expenses.

Why is the Cash Flow Statement Important?

The Cash Flow statement is one of four financial statements required by the Securities and Exchange Commission based on the U.S. Generally Accepted Accounting Principles. A cash flow statement shows changes over time rather than absolute dollar amounts at a point in time. When generating a Cash Flow Statement, a company may show the cash flow over a period of three months, six months, or a year. It uses and reorders the information from a company’s balance sheet and income statement. The Cash Flow statement is important because it tracks all the monetary activities of a company, measuring where the actual cash comes from and where it is going. It provides insight into how a firm manages and allocates its cash to debts, investments and expenditures.

Thus, for management, investors and creditors, it will be essential to review the CF statement to ensure that the business is financially fruitful.

What are the components of a Cash Flow Statement?

| ABC Inc.

Cash Flow Statement For the year ended December 31 2999 | ||

| Cash Flow from Operating Activities | ||

| Net Income | $x,xxx,xxx | |

| Depreciation | xx,xxx | |

| Increase in A/R (accounts receivable) | (xx,xxx) | |

| Decrease in A/P (accounts payable) | xx,xxx | |

| Increase in Inventory | (xx,xxx) | |

| Net cash provided by Operating Activities | xxx,xxx | |

| Cash Flow from Investing Activities | ||

| Sale of Equipment, Machinery | xxx,xxx | |

| Purchase of land | (xx,xxx) | |

| Net cash provided by Investing Activities | xxx,xxx | |

| Cash Flow from Financing Activities | ||

| Notes Payable | xx,xxx | |

| New Equity Issued | xxx,xxx | |

| Net cash provided by Financing Activities | xxx,xxx | |

| Net change in cash flow | xxx,xxx | |

| Beginning Cash Balance | xx,xxx | |

| Ending Cash Balance | xxx,xxx | |

Cash flow statements are divided into three main parts. Each part reviews the cash flow from one of three types of activities: (1) operating activities; (2) investing activities; and (3) financing activities.

- The cash flow from operating activities represents the amount of money a company brought in from its regular business activities. This includes cash generated through manufacturing and selling goods or providing services to customers. It also includes cash paid to suppliers and taxes paid.

- The cash flow from investing activities are any transactions that are related to the firm’s investment in resources for growth and production which involve long-term uses of cash. This includes cash paid to purchase fixed assets like property, a plant, or equipment. It also includes cash earned through the sale of property or equipment and a cash out as a result of a merger.

- The cash flow from financing activities focuses on how a company raised capital and how it pays it back to investors and creditors. This includes paying cash dividends, issuing or buying back more stock, and adding or changing loans.

Who is interested in a Cash Flow Statement?

There are three main players who are interested in the Cash Flow Statement:

- Investors: Current and future investors will review the Cash Flow Statement to understand how well a company’s operations are running and to view the company’s ability to generate cash and meet their obligations.

- Lenders/Creditors: Lenders and creditors will review the Cash Flow Statement to determine how much cash is available for the company to fund its operation and pay its debts.

- Management: To the accountants and the CEO of the firm, the numbers on the Cash Flow Statement will show if the company is prepared to cover their payroll and other expenses.

Where can I find the Cash Flow Statement for a specific company?

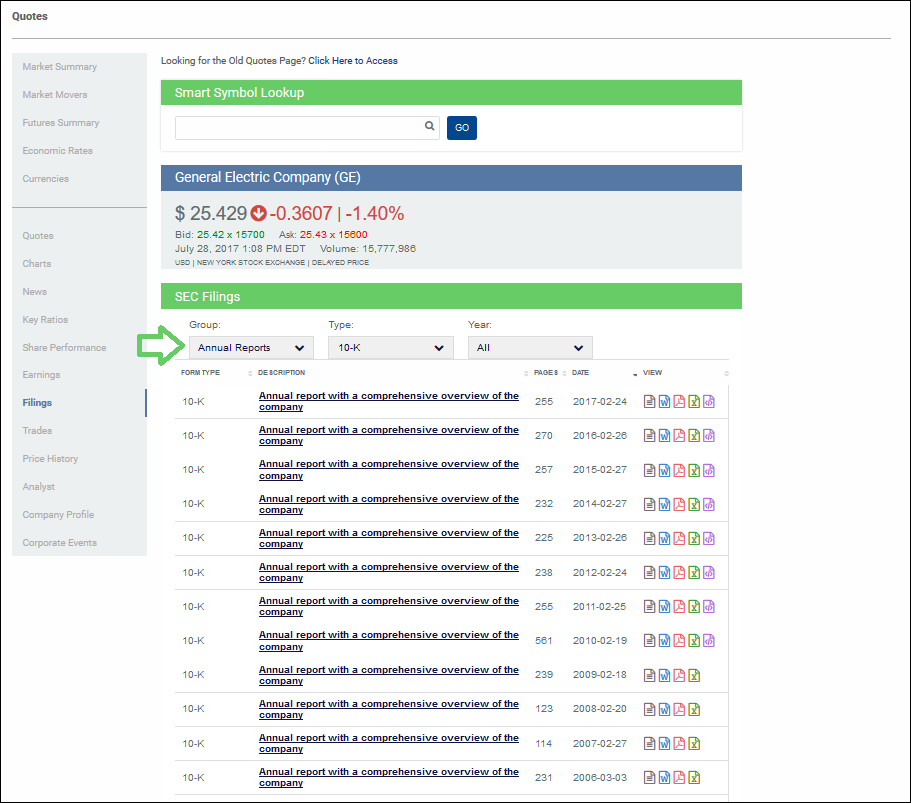

You can find the Cash Flow Statements for any company in the United States in our Quotes Tool:

Get PersonalFinanceLab

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Learn More[qsm quiz=164]